AlphaFlow is a new company that is focusing on connecting investors to the real estate crowdfunding ecosystem. Ray Sturm, who was previously one of the co-founders of RealtyShares, founded AlphaFlow in April, 2015.

Real estate crowdfunding has been getting more traction recently and there is a real need for an aggregator in the space given the immense number of real estate platforms that exist today. Similar to how NSR Invest and LendingRobot connect investors to Lending Club, Prosper and Funding Circle, AlphaFlow does the same for real estate crowdfunding. The product, dubbed AlphaFlow Exchange which launched on Monday aims to offer investors access to deals across many real estate crowdfunding sites including:

- RealCrowd

- Patch of Land

- PeerStreet

- Fund That Flip

- LendingHome (on-boarding in process)

- Sharestates (on-boarding in process)

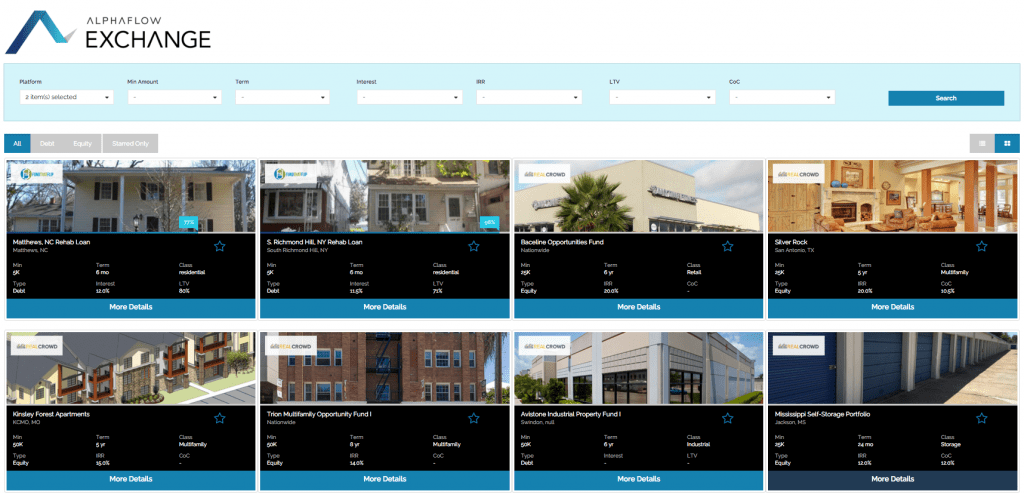

Ray noted that this will give investors access to close to 75% of the real estate debt crowdfunding deals in the market at launch, but they hope to bring every real estate crowdfunding platform on board eventually. Instead of browsing deals on each individual crowdfunding site, investors will be able to compare deals across many sites. AlphaFlow Exchange allows the ability to filter by investment criteria which allows investors to easily filter on the types of deals they like to invest in across participating platforms. Ray provided us with a demo account to take a look at the investor experience firsthand.

In the below screenshot you can see several of the real estate crowdfunding opportunities currently offered on various platforms.

[slb_exclude]

[/slb_exclude]

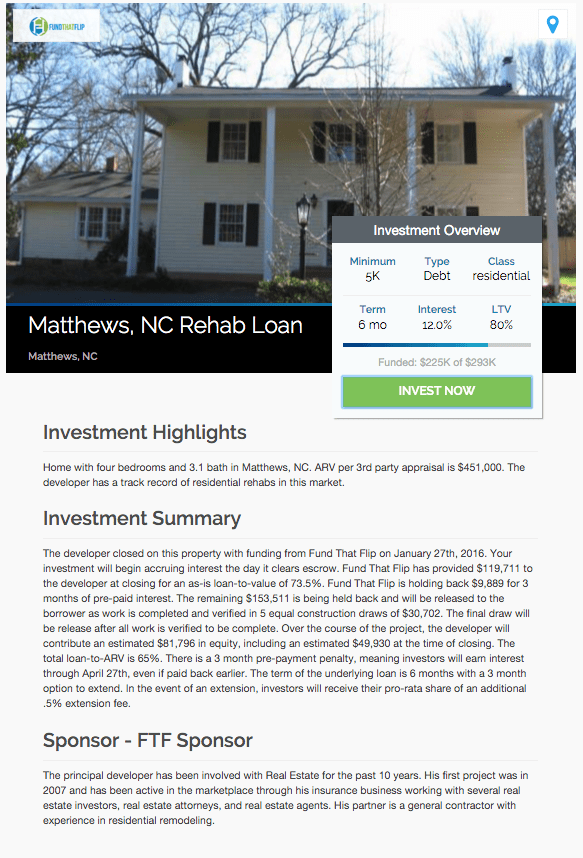

By clicking on more details, you can view additional information about the property. There is also a button to Invest Now, which will take you to the platforms website.

Deeper Integrations to Come

While what AlphaFlow has already built will help investors simplify their investing in real estate crowdfunding, Ray mentioned that deeper integrations with platforms are the future. The current investment experience forwards users to the platform’s website to commit funding in a property. In the future, platform investments will be made directly on AlphaFlow.

The features will also extend into managing a real estate portfolio. Currently, investors are able to track their investments on AlphaFlow with select platforms. Eventually they will integrate deeply into all platforms creating a comprehensive dashboard that will include all current investments, earnings, transactions and cash flow reporting.

Similar to what we’ve seen with Lending Club Open Integration, accounts in the future may be able to be created through third parties meaning AlphaFlow Exchange could be a true one stop shop for real estate crowdfunding investing.

Conclusion

In the last year we have seen a lot of growth in real estate crowdfunding, but it is also a fairly fragmented market. An ecosystem has already developed around online consumer and small business lending platforms, but AlphaFlow is the first to create the same for real estate crowdfunding. If you’re an investor on any of the real estate crowdfunding platforms AlphaFlow Exchange is worth a look. What they have provided is a great first step and the tool will prove more useful as deeper integrations are made which will allow for investing in deals directly inside AlphaFlow.