At 23 years old, Paul Gu has attended Yale, been awarded a $100,000 grant as a Thiel fellow, co-founded Upstart, attracted millions in venture capital money, and is earning a 6-figure salary as Head of Product. Wow – what were you doing at 23?

Surprisingly, Paul found it nearly impossible to get a good rate for a loan. The banks wouldn’t lend, Prosper rejected him, and Lending Club offered him a loan with an interest rate in the high 20s. What gives? Using traditional credit scoring metrics, Paul has less than 3 years of credit history and is deemed high-risk.

Paul and his team at Upstart came to the realization that he is not alone and that there is an entire category of select “thin file” borrowers who have been overlooked by the system. These are recent graduates who have entered into the workforce with very promising career trajectories.

“We’re identifying prime borrowers before anybody else sees them,” said Dave Girouard, co-founder and CEO of Upstart.

In addition to credit and salary data, Upstart uses education-related variables to predict a borrower’s earning potential, employability and their propensity to repay the loan.

“We want to support those who just finished their education and are starting a job,” said Girouard, “In addition to looking at [your credit] and your income, we look at where you went to college, what your area of study was, how you performed academically.”

Since early 2013 Upstart has originated $3.5 million worth of income-sharing agreements to 309 people backed by 2,192 lenders. Upstart has used their intelligence in the income sharing business to formulate their new product that is launching today.

Introducing the Upstart Marketplace

Starting today, Upstart has launched a marketplace much like Lending Club and Prosper to offer three-year standard term loans available in all 50 states. Borrowers can request loans of $5,000 up to $25,000, and interest rates can range from 6.5% up to 20% APR.

Upstart’s new product crosses the boundaries of consumer and student loans, which means borrowers can use the funds for pretty much anything: to pay off credit cards, retire student loans, or pay tuition for a course.

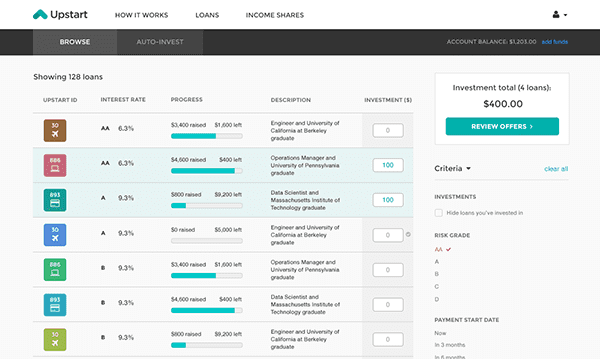

Upstart’s investor marketplace will be available to accredited investors only and will offer fractional ownership in $100 increments. As you can see in the screen shot below, Upstart loans are given a letter grade and interest rate along with a progress chart to monitor funding levels. Investors can view details of each loan, but will not be able to see the identity of the borrowers.

Upstart also levels the field among individual and institutional investors by making all loans available on equal terms. In contrast to Lending Club and Prosper, Girouard said, all investors have access to every published loan since there is only a single pool of loans. Upstart’s platform offers lenders the ability to create filters for loans in which they’re interested. The investor, then, can automatically make a bid for those types of loans as they become available.

“Investors can set up as many rules as they want,” such as setting the maximum amount, risk grade of the loan, or even how the loan is (claimed to be) used, according to Girouard.

Borrower Acquisition Strategy

“We’ll have a steady flow of borrowers,” he continued. Upstart already has partnered with 13 coding bootcamps, which normally aren’t eligible for education loans, in the United States.

Borrowers, once verified and approved, can receive funds within 7 days, and can opt to defer their first payment for 3 or 6 months.

Aside from being able to discover early prime investments, Upstart has also structured itself to bolster loan repayment by not imposing fees for early repayment, and by educating borrowers on their finances and on how to improve their credit.

This education push has already paid off for Upstart’s investments, where they’ve “seen 3,056 unique repayments to backers in 14 months without a single default.”

“We understand that our borrowers are recent graduates, so we’re adding an educational component,” said Girouard.

Upstart is Well Positioned for A Borrower’s Life Cycle

Upstart is using educational data in a new way to bring something unique to market. They are able to expand the prime borrower market by uncovering a large overlooked pocket of borrowers. They are also in a great position to establish themselves early with borrowers who will need credit for many of life’s major purchases like a new car or a new home. While nothing has been announced, we can see how Upstart may be in a position to expand their offerings to other lending categories over time.

Paul Gu will be speaking at LendIt on May 6, and his panel will be available by webcast. We hope that he posts his loan request on Upstart. We will be the first in line to fund him!

Correction: The above post misidentified Paul Gu’s title. He is the Head of Product at Upstart. Also, Paul attended Yale University and has not graduated.