A new report titled “Sustaining Momentum” was just released by the Cambridge Centre for Alternative Finance. The report includes findings from their 2nd annual European Alternative Finance Industry Survey. The Cambridge Centre for Alternative Finance produces the most comprehensive studies on alternative finance and serves as a benchmark for our industry. For those interested in digging into the details of the industry, these reports are invaluable.

Included in this study was data from 367 crowdfunding, p2p lending and other alternative finance intermediaries in 32 countries across Europe. 273 of these platforms are operating outside of the United Kingdom. According to the authors, the dataset captures an estimated 90% of the market.

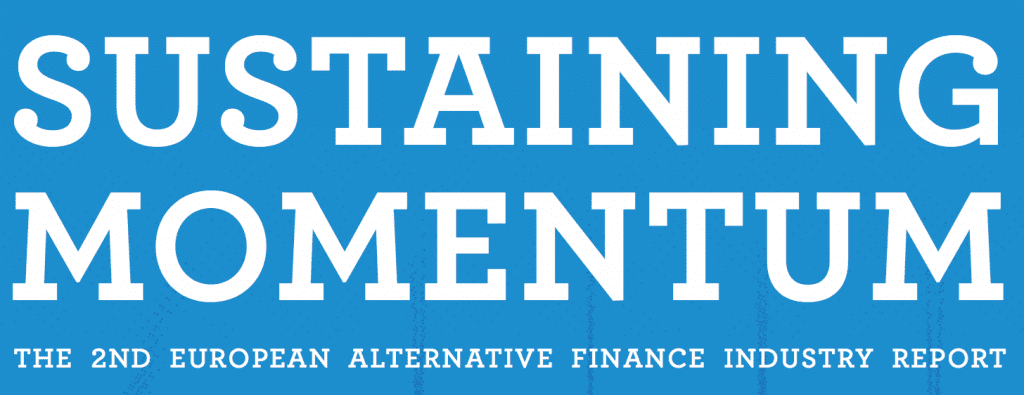

In 2015, total volume for Europe crossed €5,431m, up from €2,833m in 2014 for a growth rate of 92%. Not surprisingly the UK continues to lead the way, accounting for €4,412m or 81% of the market in 2015. Excluding the UK, France, Germany and the Netherlands are the next top countries by market volume accounting for €319m, €249m and €111m respectively. Outside of the UK, volume has now surpassed the €1bn mark.

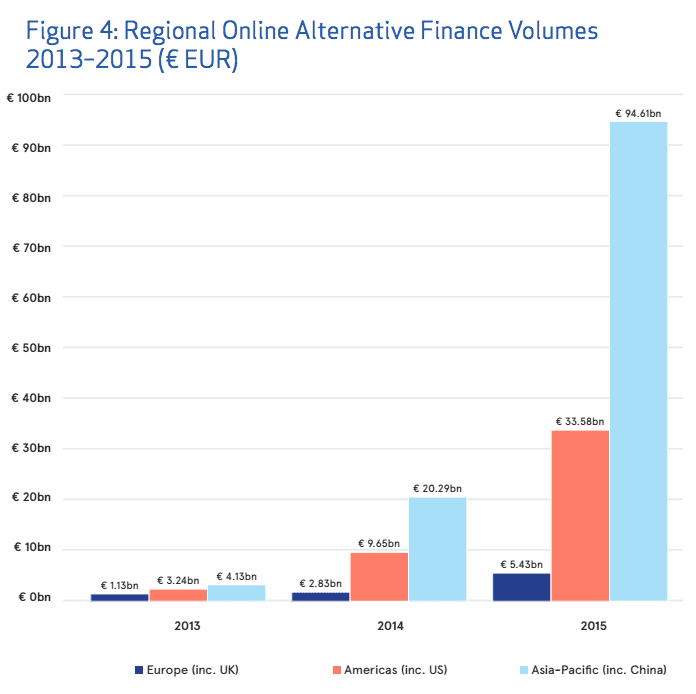

The report also compares growth and volumes across the world. Despite the growth in Europe and the United States, the Asia-Pacific market leads by a large margin in volume.

Other key findings in the report include:

- P2P consumer lending is the largest segment, followed by small business lending, equity-based crowdfunding and reward-based crowdfunding.

- Invoice trading is the fastest-growing alternative finance model.

- Institutions now account for 26% of the funding for p2p consumer lending and 24% of small business lending.

- Bidding on loans is largely automated (82% of consumer loans, 78% of traded invoices and 38% business loans).

- 38% of platforms felt their national regulations were adequate and appropriate. 28% believe them to be too excessive and too strict.

- Biggest risks perceived for those surveyed include increasing loan defaults, business failures or fraudulent activities.

This is just a taste of what is included in recent report. If you’re interested in learning more, you can view or download the report for free on the University Of Cambridge website.