There is no summer break for Lending Club and Prosper. Both had a busy month with more record numbers. The total of new loans issued at both companies was $203.8 million in July up from $185.6 million in June. They helped more borrowers find funding than ever before – a record 15,154 loans were funded in July.

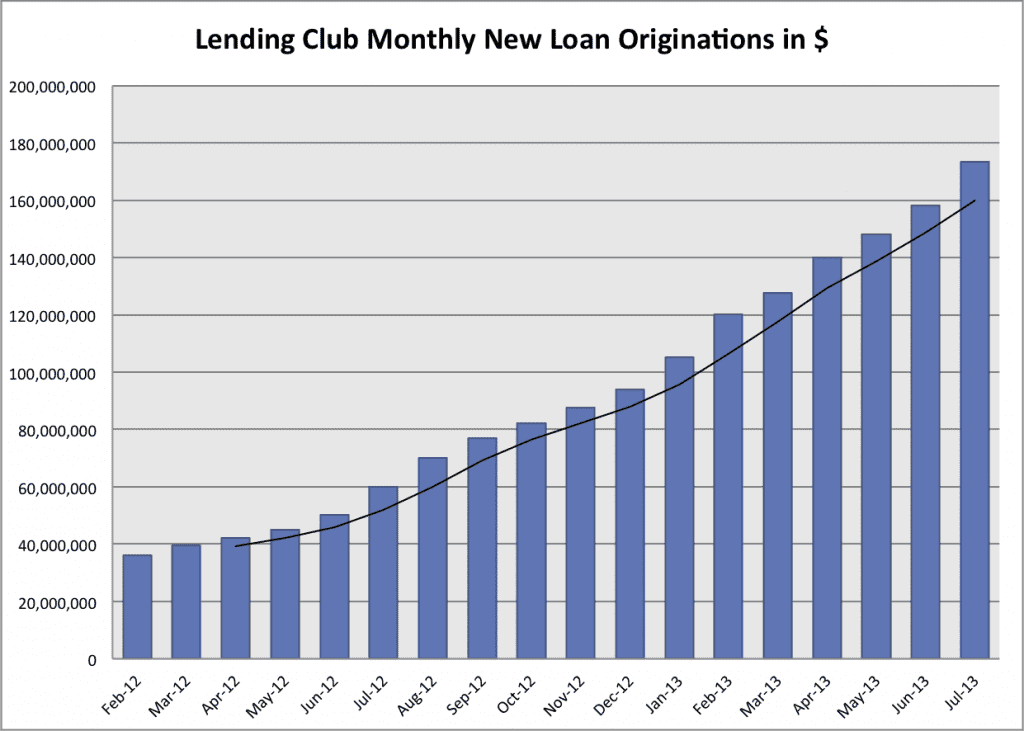

Lending Club Issues $173.5 Million in July

July was another truly outstanding month for the world leader in p2p lending. The big news at Lending Club this month came early, on July 2nd, when they passed $2 billion in total loans issued since they began operations in 2007. This happened less than eight months after crossing $1 billion for the first time on November 5th last year. As they shared on Twitter at the time, the first billion is always the hardest…

Digging in to the numbers a little we see that the $173.5 million was made up of 12,220 new loans for an average loan size of $14,194 which is actually their lowest average loan size of the year. They are certainly not focused on increasing the dollar amount of new loans right now. But as I wrote about earlier this month despite this huge volume of new loans there are many more investors looking for loans than loans available. Lending Club could easily issue double the loan volume in August and come nowhere close to satisfying investor demand. The investing world is starting to realize what many of us have known here for years: p2p lending is a great investment.

Below is Lending Club’s always impressive 18-month chart. The black line is the three-month moving average.

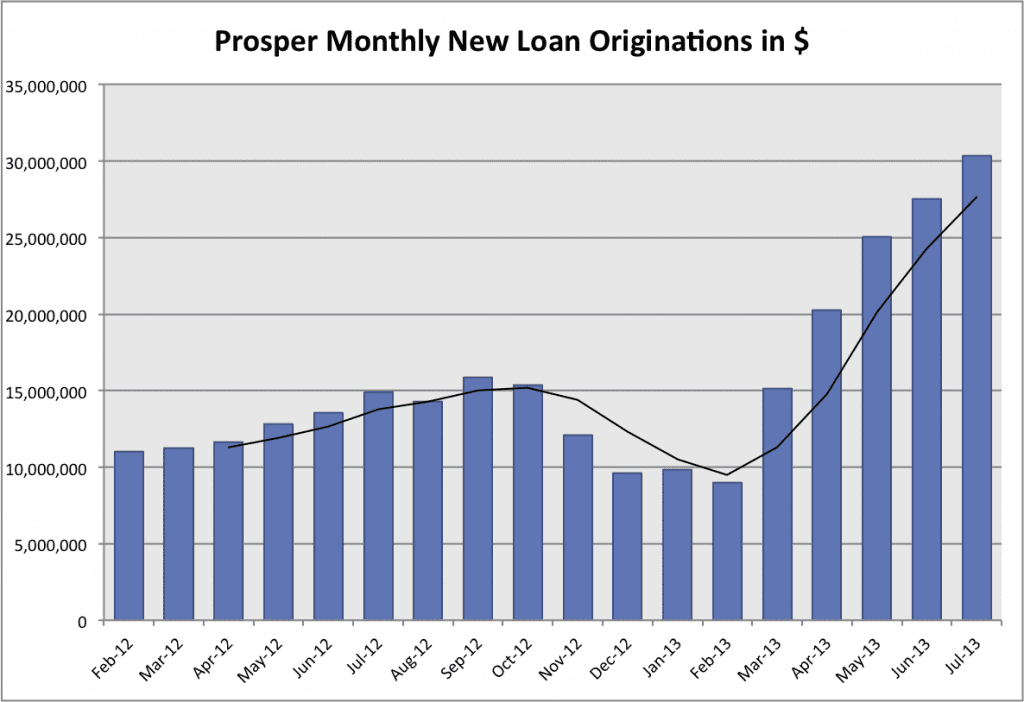

Prosper Crosses $30 Million in New Loans Issued

Anyway you slice it July was a great month at Prosper. They continued on their impressive growth run, issuing $30.3 million in new loans up from $27.5 million in June. They issued 2,934 loans meaning the average loan size was $10,332 which is roughly where it is has been the last four months. Since March the new management at Prosper have been on a tear. They have gone from $20 million in new loans issued to $30 million in just three months. To put that in perspective, Lending Club took six months to grow that same amount back in 2011.

In my now regular end of month call with Prosper president Aaron Vermut he said he is obviously very pleased with the way everything has been going. He always talks about the team and how there is great morale at the company as they keep hitting their monthly goals. That is great for Prosper but what really interests investors right now is borrower inventory. Investors, particularly retail investors, are struggling to get the supply of loans they want. He addressed this issue head on and said Prosper is working on attacking loan inventory on three fronts:

- More marketing to attract a higher number of quality borrowers to Prosper’s site.

- Working on lowering the cost of acquisition of these borrowers.

- Increasing the conversion rate of borrowers visiting the site.

He said they are revamping their entire borrower experience on their site so it will be easier for new borrowers to apply for a loan. This should lead to much greater inventory of loans for investors in coming months.

Below is Prosper’s 18-month chart that demonstrates their rapid growth the last five months.