Back in October last year LendingClub executives ran an exercise where they had to game plan how the company would...

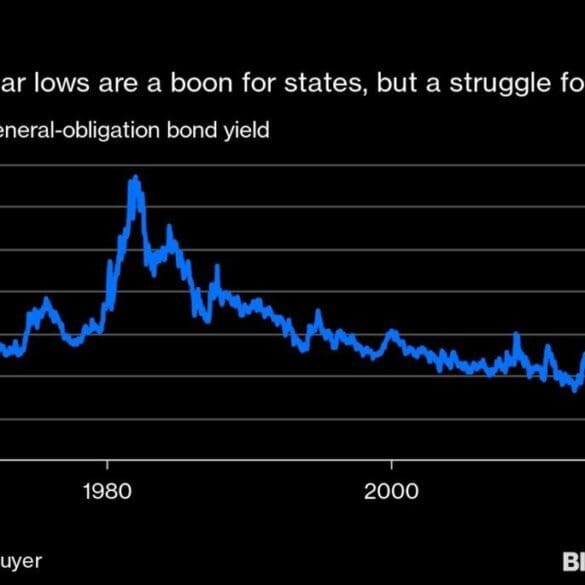

I reflect on ConsenSys acquiring a broker/dealer focused on municipal bonds, and why we believe that blockchain-native platforms are a fantastic fit for this $4 trillion asset class. Can direct holding of franctional munis enable deeper community participation and usage of common resources? Are there new sources of liquidity to unlock? At the same time, there are real dangers. I compare the evolution of digital lenders and their funding sources against the current possibilities in municipal bond markets. We also look into the reasons that some innovative Fintechs have failed to achieve their stated missions, and what can be learned and done better.

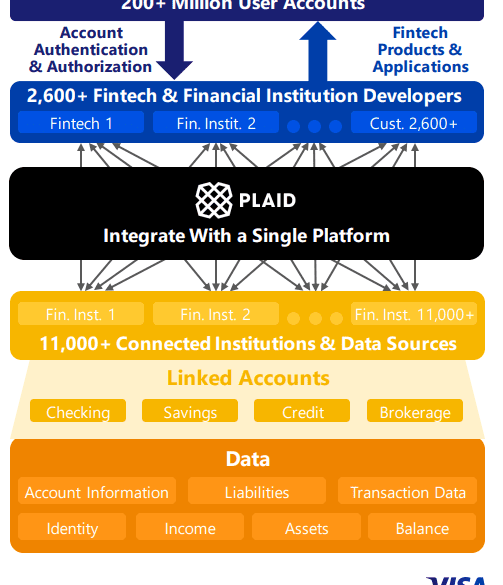

I dig deeply into the $5.3 billion acquisition of data aggregator Plaid by $500 billion payments network Visa. We examine why this deal is worth 25-50x revenue, while Yodlee's sale to Envestnet was priced much lower. We also look at how Plaid could be an existential threat to Visa, and why paying 1% of marketcap to protect 200 million accounts may be a good bet. Broader implications for product manufacturers across payments, investments, and banking also emerge -- the middle is getting carved out, and infrastructure providers like Visa or BlackRock are moving closer to the consumer.

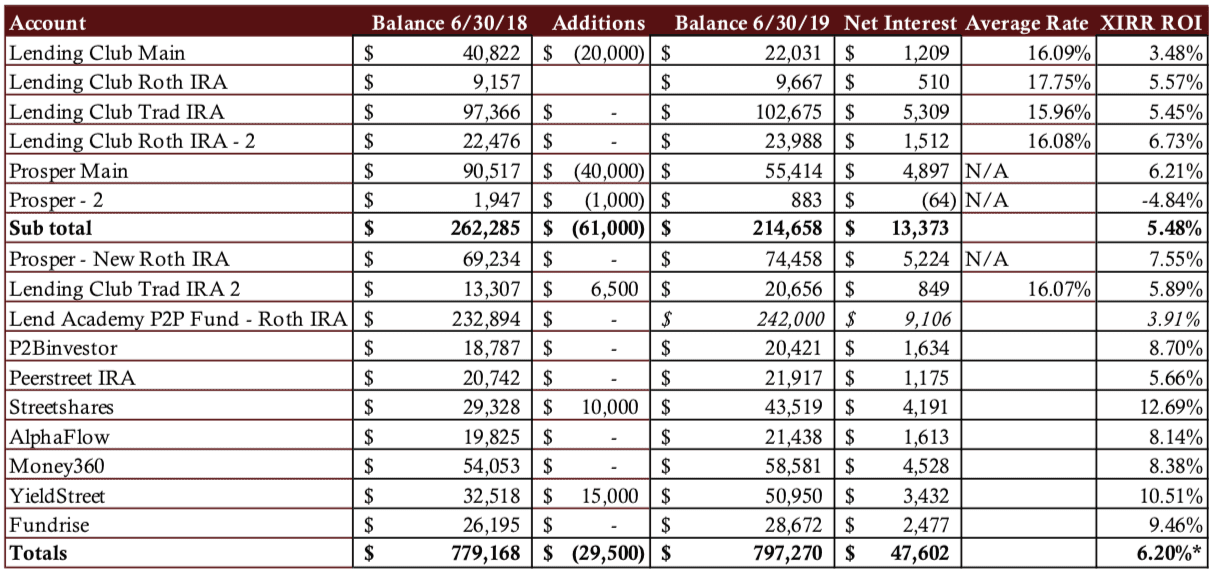

[Update: an earlier version of this post had the preliminary return number of 6.20% as I awaited for the final...

This month marks ten years since I made my first investment in what was then called peer to peer lending....

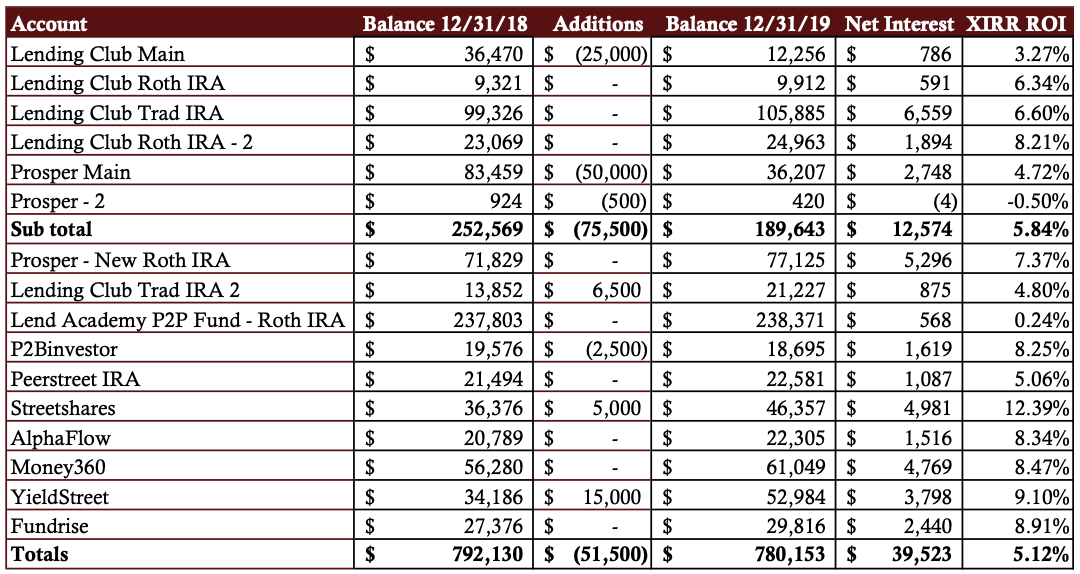

I have finally been able to conclude my quarterly returns report from Q4 of last year. I have been sharing...

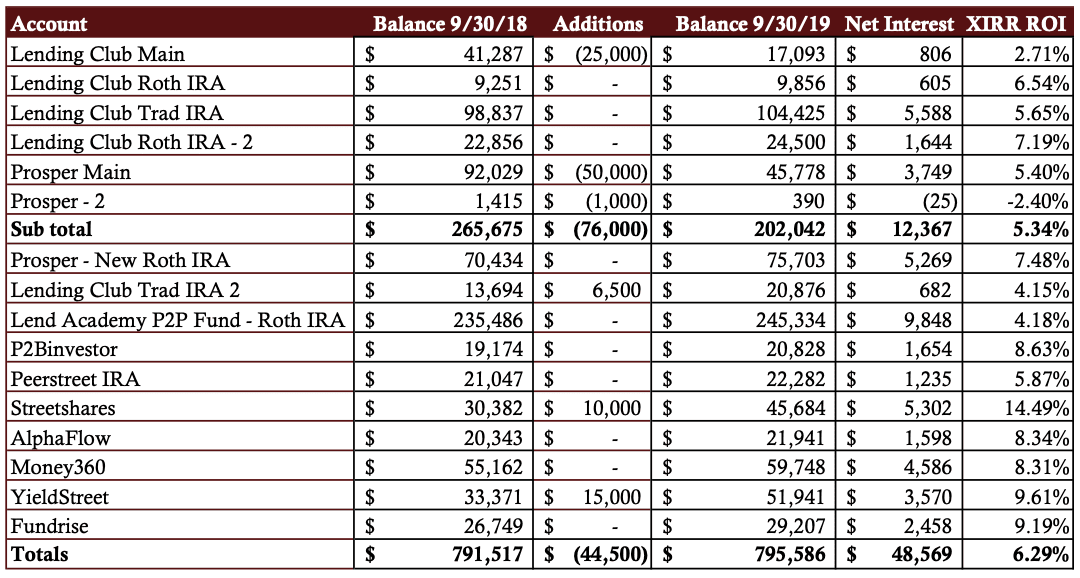

I am certainly late with this but I have finally found the time to bring you my quarterly returns report...

I started writing about marketplace lending back in 2010, so I have spent almost the entire decade immersed in this...

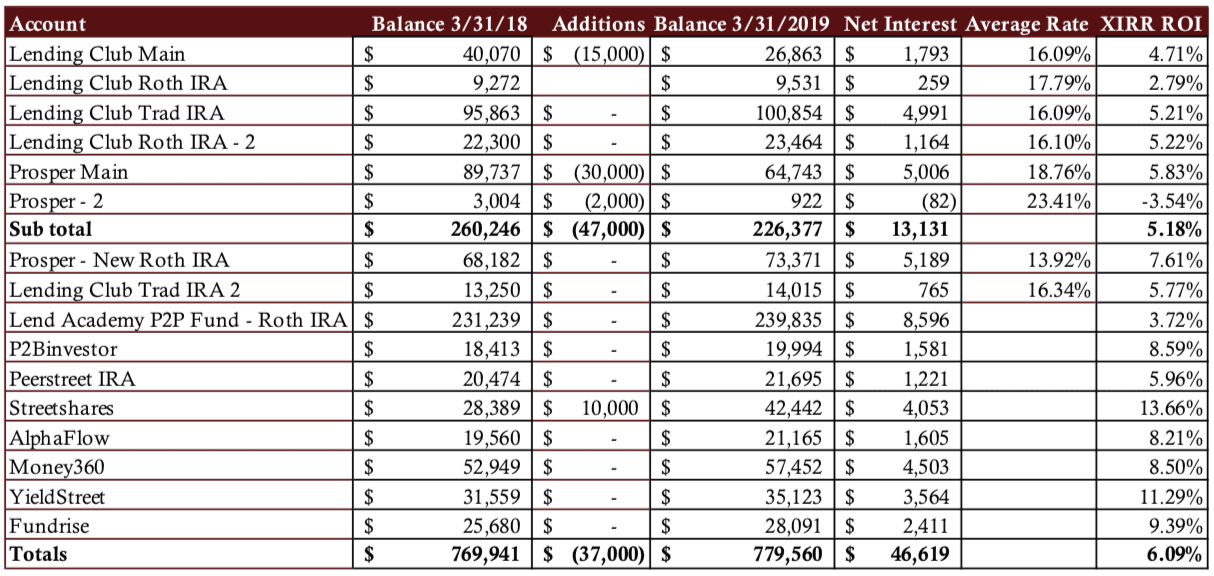

Put this in the “better late than never” department. Yes, I know it is late July and I am only...

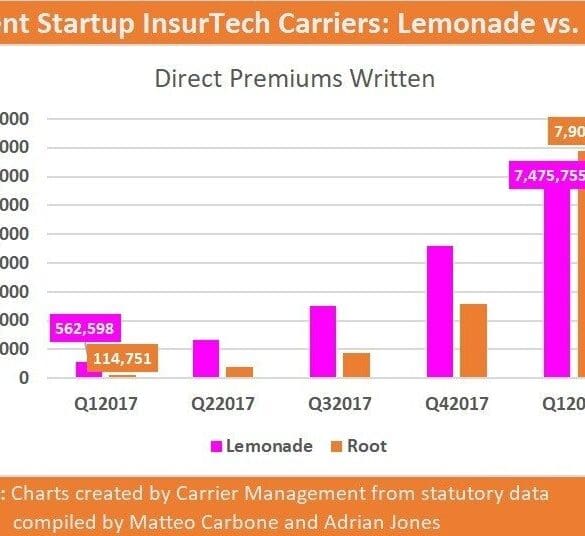

I've been seeing a lot of Fintech headlines recently that make me raise my hands in the air, and go "Come on, are you for real!?". I imagine a lot of people feel similarly frustrated by Lemonade looking to go public at a $2 billion valuation on $50 million of revenue, Initial Exchange Offerings on crypto exchanges raising over $500 million this year, Facebook's tone deaf Silicon Valley club crypto money, or SoftBank talking about selling its overpriced $100 billion Fintech unicorn fund in an IPO. So other than getting crankier with age (Happy Father's day everyone!), I want to dig a little bit into the concept of fairness, asymmetric information, economic rents, and how this can help disentangle feelings from thoughts on these news items.