[Editor’s Note: This is a guest post from Bill Ullman. Bill has over 20 years of financial services experience as an investment banker, operating executive, investment manager and Board member. Prior to starting his own firm, Right Wall Capital Management, LLC in 2006, Bill was a senior banker and executive at Bear Stearns and Merrill Lynch, always focused on the financial services industry. Bill advises a select group of clients on strategy and corporate transactions.]

“Sunlight is said to be the best of disinfectants…” Former US Supreme Court Judge Louis Brandeis

The old guard is trying to define marketplace lending as part of a murky “shadow banking” industry. Banking analyst Richard Bove concluded in a recent Rafferty Capital Markets research report on Kabbage that, “small banks are not growth businesses… shadow banking companies are.”

Earlier in March, a leading investment bank – one that Rolling Stone Magazine compared to a “great vampire squid” – proclaimed that the future of banking belongs to “Shadow Banks.” I am not sure whether it is predictable or ironic that the people who brought us CDO-squared transactions in 2007 now provide us with a view that the future of banking will continue to reside in the shadows. Shadow banks – operating in low/no tax and regulatory jurisdictions – are often associated with the very roots of the Global Financial Crisis in 2008.

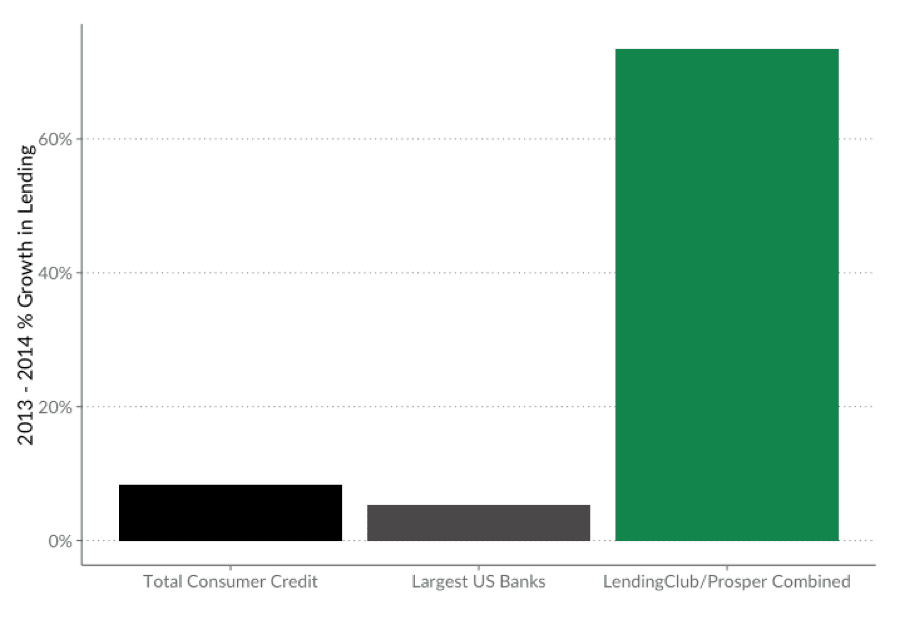

I propose the opposite of the old guard: namely, that banking’s future belongs to “Sunlight” financial institutions and fin-tech companies, aka marketplace lenders. Labeling marketplace lenders as shadow banks is incorrect, misleading and full of negative connotations. As Aaron Vermut, CEO of marketplace lender Prosper Inc. recently told CNBC: “we don’t consider ourselves to be ‘shadow’ anything.” The differential growth rates between traditional lenders and the new class of marketplace lending firms is staggering and suggests the future of credit origination lies with those engaging in “Sunlight Banking.”

Marketplace lenders are providing investors with host of benefits: timely disclosure, accurate and plentiful data, market pricing and transparency. In short, these companies are providing investors – the funders of the loans – with sunlight. And they are providing borrowers with sunlight benefits too: clear, swift, mobile and user-friendly customer interfaces; competitive rates; ultra-fast credit decisions.

Chart 1 – Differential Growth Rates of “Sunlight” Banking versus Traditional Banks

Sources: Total US Consumer Credit data from The Federal Reserve; Largest banks include WFC, BAC and JPM; Orchard Platform data.

The Three “T”s

What are the key reasons “Sunlight Banking” represents the future and “Shadow Banking” does not? The three Ts: transparency, technology and trust.

- Transparency. Each loan that is originated on the Prosper platform, for example, comes with over 200 data points for an investor to consider, including loan details, borrower credit history, FICO score, public records, employment, income, geographical data, etc. With all of this information, investors can make informed decisions about funding loans. Furthermore, investors can build portfolios of loans that have desired characteristics (maturity, geography, FICO score, etc.) based on all of this data. This transparency is also critical to measuring and improving performance over time as historical loan performance data can be incorporated into models.

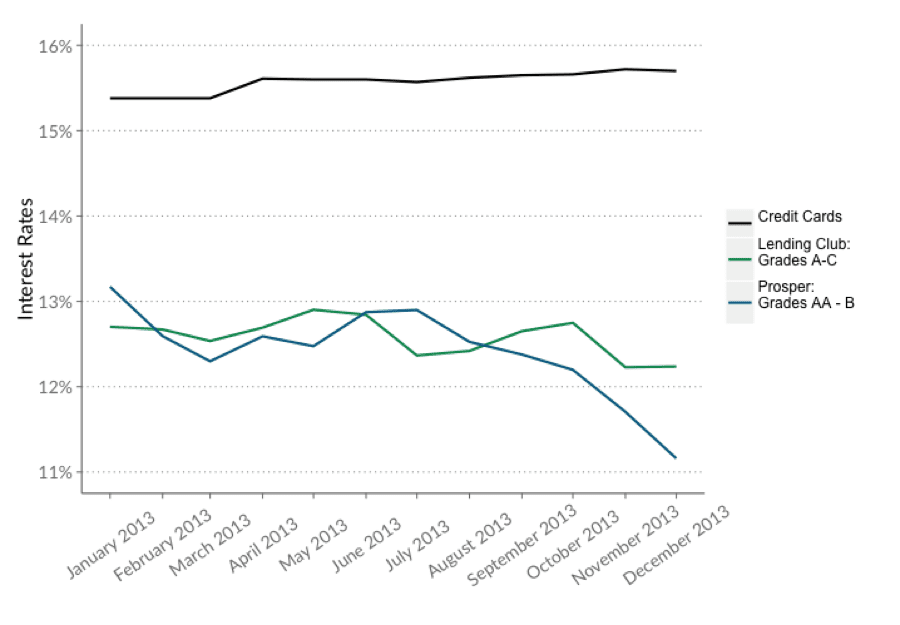

- Technology. Because of their technology, user-interfaces, lightning fast access to data and mobile solutions, these new marketplace lenders are engaging borrowers and growing more rapidly than traditional lenders. Technology enables speed, efficiency and for the delivery of credit products and transactions across multiple platforms – smartphones, iPads, desktops, etc. Most bank websites are not as accessible, easy to use or focused as marketplace lending interfaces.Borrower experiences have improved in another important way – lower rates. Competition for borrowers amongst marketplace lenders and continued technological advances are driving down interest costs on unsecured consumer loans, for example. Chart 2 below shows this graphically.

Chart 2 – Interest Rate Comparison – Credit Cards versus Marketplace Lenders

Sources: credit card rate data from www.bankrate.com and LendingClub and Prosper data calculated by Orchard Platform.

- Trust. The banking industry remains challenged from client trust point of view. Regulators continue to prosecute past bad behavior by the banks. Negative headlines, whether regarding manipulation of LIBOR or weaseling out of the Volcker Rule continue unabated. At a recent fin-tech conference in Sydney, Australia (an indication that the sunlight banking trend is global) former Citibank CEO Vikram Pandit noted that while the banks have made progress since the crisis, “many bank customers aren’t entirely convinced that banks are focused on servicing their needs…the trust still isn’t what it should be, and in fact the gap may be getting wider.” Lack of trust is a widening void into which fin-tech disruptors are jumping and grabbing market share.

Conclusion

The three Ts evidenced in marketplace lenders – transparency, technology and trust – are changing the way loans are originated and distributed. They are transforming this corner of financial services into one that operates in sunshine – with data driven decisions and efficiency. “Sunlight” banking models will continue to proliferate – expect lots of growth and the adoption of marketplace lending technology by traditional lenders.

Giant vampire squid still inhabit the ocean of credit origination and distribution. But many new creatures are evolving in this ocean, not in the deep, dark depths, but in clear, shallow, transparent water.