Matt Symons has big plans. He is the co-founder and CEO of Australia’s first fully compliant p2p lender called SocietyOne. Sure, he wants to be Australia’s version of Lending Club and dominate the market down under but he sees that as a narrow vision.

Symons’ goal is to reinvent the concept of the personal loan. That is a big goal but his company is already backing it up with action. SocietyOne won best in show at the recent Finovate Asia conference for their ClearMatch technology platform, which automates virtually every aspect of the loan underwriting process.

I urge everyone to watch this video of their demo at Finovate Asia. It is one of the most innovate demonstrations I have seen from any company in this industry.

Symons believes that the platform of choice for obtaining a personal loan in the future is going to be the mobile phone. Here is what he had to say about this when I chatted with him recently:

We are trying to make the personal loan a product that can compete successfully with the variety of other credit options that exist that currently win because of ease and convenience. In our analysis the reason that people don’t use personal loans more often is that it is perceived to be a hassle and a lot of effort to apply for one. If you can make the personal loan something that is easy for people to get on a phone then people will use a fixed payment-type personal loan instead of a credit card.

This makes perfect sense to me. This decade will likely see the phone become the payment vehicle of choice as initiatives like Google Wallet and Apple Passport take hold. Once consumers become accustomed to using their phone for everyday purchases it is not much of a stretch for them to use their phone for bigger ticket purchases funded by a personal loan.

Today, users of SocietyOne’s SmartLoan application (currently still in beta release) can apply for a loan, get approved and funded in just three minutes as they demonstrated in the Finovate video.

How does this work? Once a user has downloaded the SmartLoan app to their phone and registered as a user they can obtain a loan in just a few steps. The underwriting is all done with SocietyOne’s ClearMatch technology platform that has been tried and tested in a traditional banking environment that issued over $1 billion in loans. The really cool part of the software is that once a loan is listed on the SocietyOne platform it can be immediately funded by investors. I imagine this is done in a similar way to Prosper’s Automated Quick Invest, so if the loan fits investors’ criteria they automatically place a bid and if enough investors bid the loan gets funded. Obviously that can happen very fast, in a matter of seconds.

The exciting part of all this is that we are only seeing the first version of their software. As the platform gets more sophisticated this process could happen even faster particularly for repeat borrowers. Then we will have a product that will compete directly with a credit card and will truly revolutionize the purchase of big-ticket items.

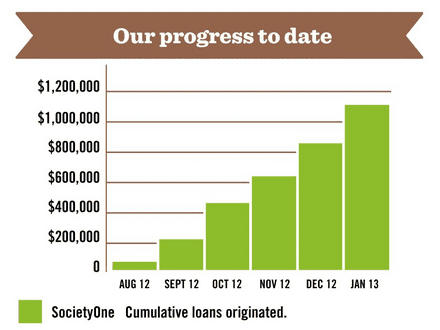

How is SocietyOne doing so far? They began operations in August last year and they just crossed over the $1 million milestone in total loans issued in January. Yes, it is a humble beginning when compared with the huge volume at Lending Club but it is all going according to their plan.

Unlike Renaud Laplanche, the CEO of Lending Club, who is maintaining his company’s focus purely on unsecured personal loans, Symons believes the future for SocietyOne is across multiple asset classes. As soon as later this year they are looking to expand into new areas including secured loans. There is nothing they can share publicly yet but there are some interesting innovations in the pipeline.

With just 15 employees it is clear that SocietyOne is fighting above their weight. They may well be the most innovative p2p lender on the planet and clearly the management of Lending Club and Prosper could learn a thing or two from them.

I may be biased because they do hail from my hometown of Sydney but I think this Aussie startup is destined to make a big impact on the p2p lending industry.