One of the goals of this blog is to teach investors how to get an above average return on their p2p lending investment. Lending Club claims their average investor return is in the 8-9% range and Prosper says theirs is in the 9-10% range.

In reality though, the average investor is probably earning a real return that is 1-2% less than those numbers. Now, 7% can seem like a great return today given the alternatives but I want you to do better than that. Much better.

So, I have been doing some research the last few days trying to come up with a very simple filtering strategy that has produced returns that are well above average over the last four years. I wanted to limit myself to just three criteria to keep it simple but at the same time I wanted there to be enough loans to choose from so investors can put their money to work quickly.

The Simple Lending Club Investment Strategy

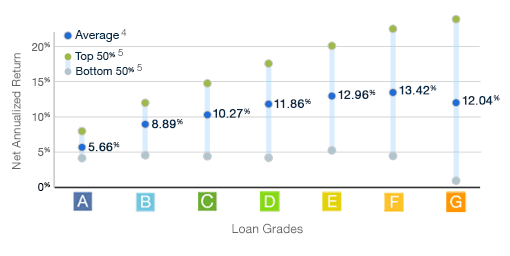

Take a look at this graphic below from Lending Club’s site. This shows the average investor return, according to Lending Club, for each credit grade. The bottom line is that the easiest way to increase returns is to focus on the riskiest credit grades. This chart was taken from Lending Club’s site this week and is up to date as of December 7th. They have updated this chart regularly since it was introduced 18 months ago and it is always the lowest four credit grades that have produced the highest returns.

There is no guarantee that the future will produce similar results and I should point out that it is more risky focusing on the lower grade loans but it has historically been the easiest way to produce above average returns.

Let’s cut to the chase. Here are the three criteria I have chosen for a simple investment strategy that has produced above average returns in the past.

- Credit grades D, E, F and G

- Inquiries in the last 6 months = 0

- Loan Purpose: credit cards, debt consolidation

The question you probably want to know is how have these loans performed historically. The table below provides the details. I broke up the returns into two segments: 2009-2010 and 2011-2012. I did this because I wanted to see how this strategy has changed over time. The key number is in the last column – that is the percentage above the average return. If you had employed this strategy over the last four years you would be 3.5% – 4% above the average investor.

[table id=38 /]

You can see the most up to date returns for these criteria on Nickel Steamroller (where I did my research) – click here for the 2009-10 returns and here for the 2011-12 returns.

The Simple Prosper.com Investment Strategy

At Prosper there is a similar trend for credit grades. The bottom four credit grades have historically provided the best performance, at least for Prosper 2.0 loans. The chart below shows seasoned returns, meaning it only takes into account those loans that are at least ten months old. It is up to date as of September 30, 2012.

Long time readers may be surprised by the three criteria I have chosen for Prosper – it doesn’t include one of my historically favorite groups: repeat borrowers. While repeat borrowers have provided excellent returns in the past I have noticed a recent downward trend which is why they didn’t make the cut for my three criteria. Here are my three criteria that have consistently performed well.

- Credit grades C, D, E and HR

- Inquiries in the last 6 months = 0

- Open credit lines >= 10

So, basically we have very similar criteria to Lending Club, just swapping out loan purpose for number of open credit lines. But the difference in returns at Prosper is even more impressive than at Lending Club. We are talking returns of 5.5% – 7% above average and with plenty of loans to choose from. Here is the table showing the breakdown.

[table id=39 /]

I produced these numbers from Prosper Stats – you can also follow these links and see how they perform over time. Click here for the 2009-10 returns and here for the 2011-12 returns.

Words of Warning

First, I should point out again that investing in the lower credit grades is inherently risky and not for everyone. You will receive many defaults even with the suggested filtering. And if we do go over the fiscal cliff and fall into a deep recession again then these lower grade loans will likely be hit the hardest. So, there is no guarantee that they will produce above average returns going forward.

Second, as I say in my disclaimer the information in this post should not be construed as investment advice – I have no formal qualifications so I am not able to provide such advice.

So now I turn it over to you. What do you think? Are their better ways to generate above average returns using just three filters? As always I like to hear what you think.