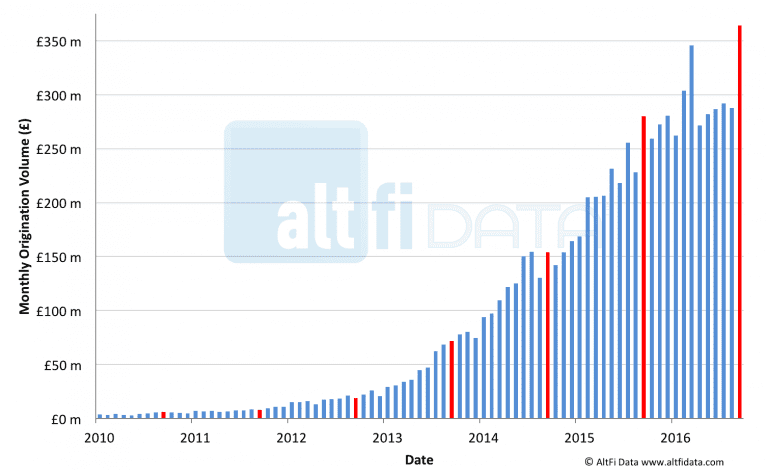

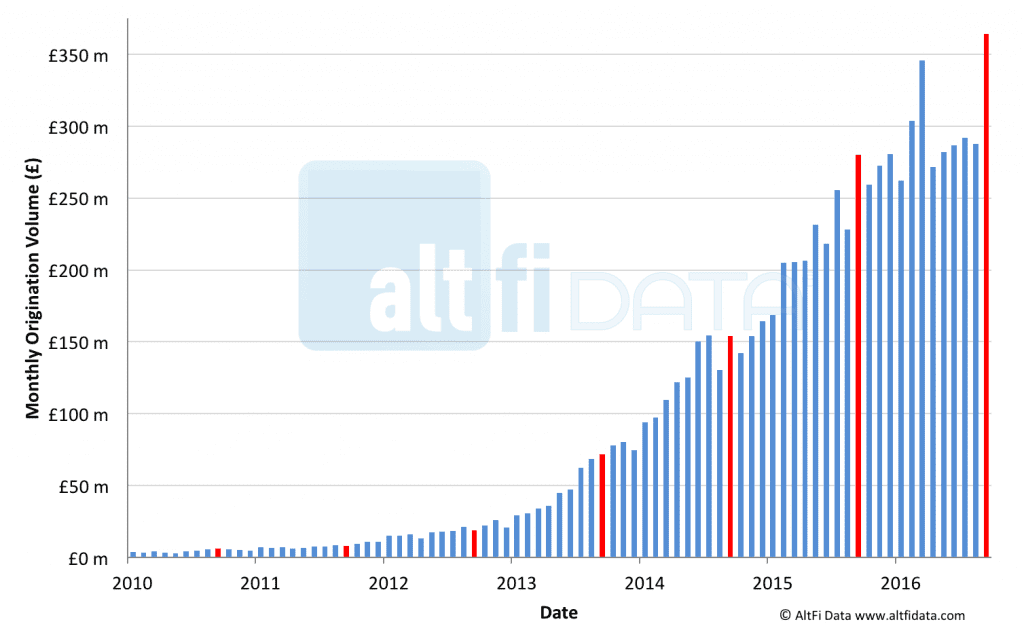

According to the Liberum AltFi Volume Index, September 2016 originations for online lenders hit £364m in the UK. September was a record month, beating out the previous record set in March, 2016 by £18.5m. Over the summer originations were stagnant across the industry as seen in AltFi’s chart below of originations since 2010. They have highlighted the September months to show seasonality as September has historically been a good month for originations.

If history is an indicator, we may see originations drop again in October but it’s important to note that even in this challenging year for the online lending industry, UK originators have still managed to grow.

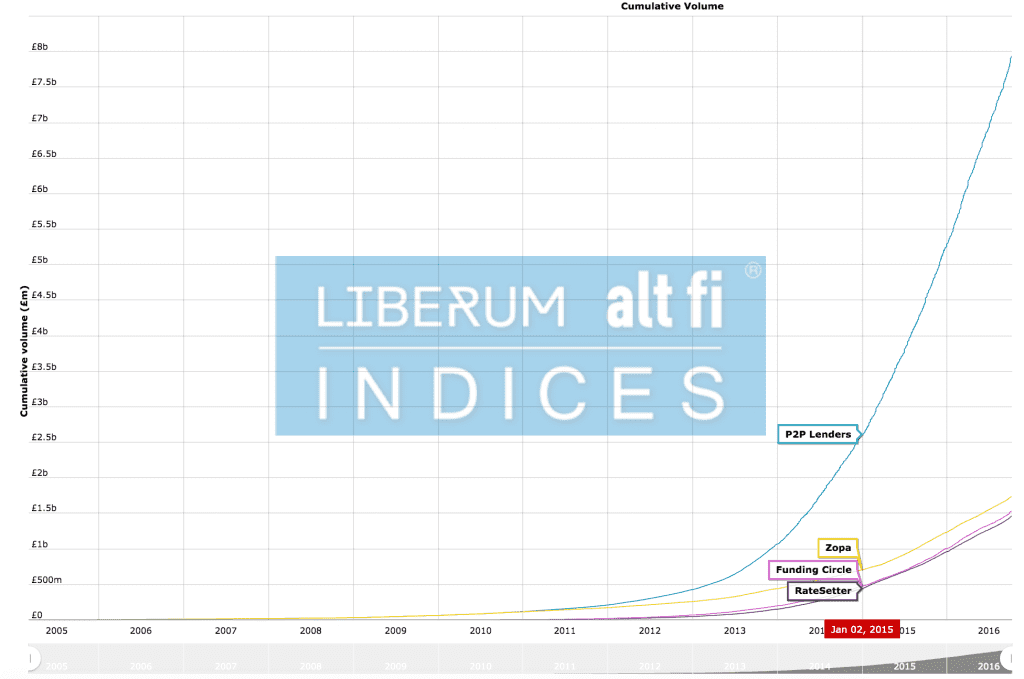

Not surprisingly leading platforms Funding Circle, Zopa and RateSetter all had record months. According to AltFi Funding Circle, RateSetter and Zopa originations were £75.2m, £74.3m and £67.8m respectively. Funding Circle officially crossed the £1.5bn mark in cumulative volume. The below chart shows cumulative lending across the three leaders and p2p lenders as a whole.

In their article today AltFi said the reason for the increase in lending is not due to more institutional investor activity. Seems like this is a more retail investor driven boost. They provide these data points:

- 46% of Funding Circle’s September origination came from whole loans, which are favored by institutions, but this is lower than the high of 60% in March 2016.

- Similarly, 50% of Zopa’s origination was not covered by Safeguard (favored by institutions), down from a high of 60% in February 2016.

- 98.5% of RateSetter’s origination was covered by its Provision Fund, indicating that institutional money still makes up a small portion of its overall lending.

Conclusion

While it certainly has been a challenging year for p2p lenders across the globe, September numbers coming out of the UK are encouraging. It will be interesting to hear the perspectives of various platforms across Europe at next week’s LendIt Europe event.