Many folks find it valuable to learn how others are investing on both Lending Club and Prosper, especially when they are first getting started. Many strategies are discussed on the Lend Academy forum. I thought I’d share how I am specifically investing in both Lending Club and Prosper. My strategies have changed over time and I am currently using one automation/analytics tool with third party credit models. As you read this, keep in mind that I have a relatively small amount in my p2p lending accounts with around $20,000 invested. This certainly has an effect on investment strategy.

None of this information should be considered investment advice and I do not recommend you follow my strategies. You should consider your own situation and risk tolerance before making investment decisions.

Automation/Analytics Tool Choice

I have written at length about all of the sites for analytics and automation tools. I personally use Nickel Steamroller for everything and there are a few reasons for this. I view it as an all-in-one tool. This means that with one account, I can do portfolio analysis, detailed backtesting and automation. They also support both Prosper and Lending Club for all of these features, which makes it easy to keep track of multiple accounts.

Most importantly, they have built-in support for the credit models I use from P2P-Picks. When new loans are added at Lending Club and Prosper, Nickel Steamroller immediately executes my auto investment criteria. I am provided with updates on orders submitted and at the end of the week, I receive a weekly summary. Nickel Steamroller integration with P2P-Picks is not currently available to the public. However, there are other options for retail investors. BlueVestment supports P2P-Picks for Lending Club and PeerTrader has integrated with P2P-Picks on the Prosper side.

Philosophy on Filtering

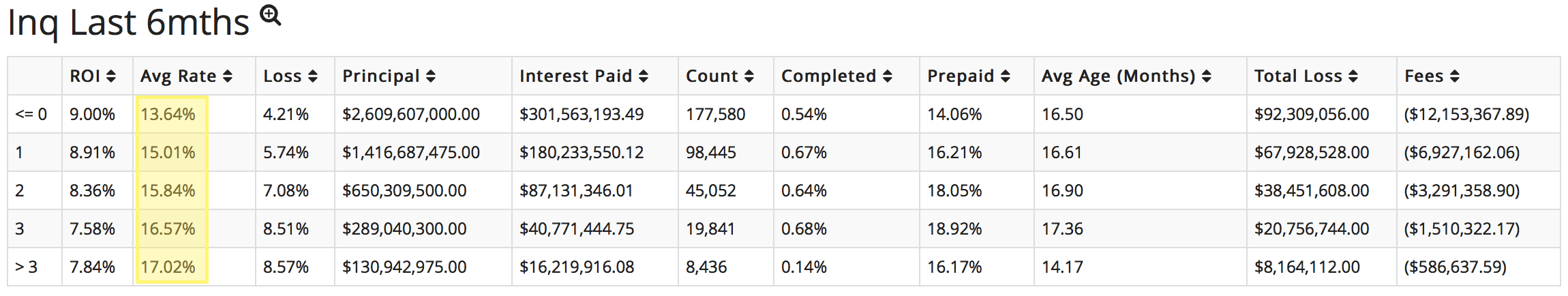

I personally believe that eventually the ability to achieve outsized returns simply by filtering will diminish. In the meantime, using filters is a fine strategy and used by many seasoned P2P lending investors. It is pretty well known that simply filtering out loans with inquiries greater than zero yields higher returns. There are several other data points that also are commonly used, such as annual income.

However, as underwriting continues to improve, rates will be more appropriately adjusted to account for the risk of default. You can see this happening simply by looking at the higher average rates as inquiries increase.

Personally, I enjoy a completely hands off strategy where I don’t have to think much about filter criteria and loan availability.

P2P-Picks Strategies

Instead of just looking at a few filter criteria, I like what the credit models have done. Third party tools are beginning to create genetic algorithms and there are also the well known credit models from P2P-Picks. These models look at historical data and determine what combinations of attributes yield the best results.

In the case of P2P-Picks, they bring in other sources of data from the Bureau of Labor Statistics and the Federal Reserve Economic Database. These other data elements can help the model by looking at default risk when it comes to macroeconomic factors. P2P-Picks currently offers two models for both Lending Club and Prosper, which are all for 36 month loans. The Profit Maximizer model is estimated to provide between 9-11% ROI and the Loss Minimizer has a 5-7% estimated ROI.

Keep in mind that these models were created with the intention that institutional investors could put massive amounts of money to work. I have never had an issue with loan availability. As historical data continues to be released, the credit models are updated.

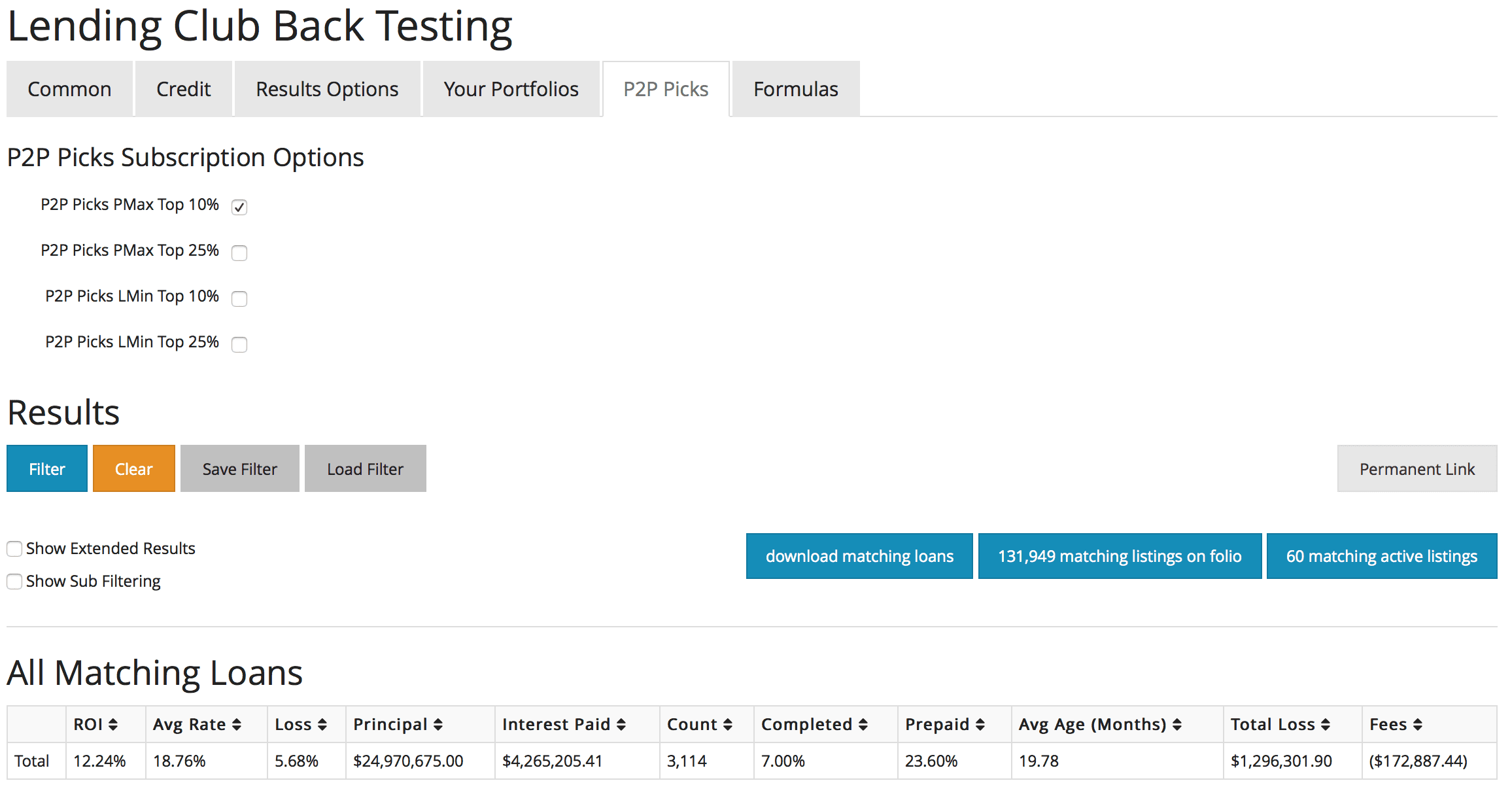

The P2P-Picks integration works great with Nickel Steamroller and it is nice having the option to add additional filter criteria. Additionally, backtesting works when selecting a P2P-Picks model, which allows for users to easily see what returns have historically been using each model.

I have added a few filters to each model to try and maximize my returns. This is solely due to the historical ROI on these strategies. For Lending Club, I find that D and E grade loans are the sweet spot for a ROI around 10%. I believe that F grade loans are not worth the additional risk and will have much less consistent returns. (G grade loans are not included in the model) In addition to that, loan purposes of credit card and debt consolidation have historically some of the highest returns. There are a larger quantity of loans stating these purposes, which makes me more confident in the model and the returns I will see.

On my Prosper account, I am taking a little more risk by venturing into the E grade loans. With the P2P-Picks model, the average rate on these E grade loans is 27.15%. Similar to my Lending Club account, I’ve chosen the two loan purposes with the highest historical loan counts. Finally, I only invest in loans where the borrower has zero or one inquiries in the last 6 months. This filter has historically produced better returns.

Lending Club – P2P-Picks Profit Maximizer Top 10%

Grade: D,E

Purpose: Credit Card, Debt Consolidation

Using Nickel Steamroller’s backtesting, the stated ROI is 12.10% for notes that were originated before 2014. This estimate is still probably a little high and my actual account with these notes hasn’t aged enough to give an accurate return. P2P-Picks represents about half of my overall portfolio with over 500 notes being purchased.

Prosper – P2P-Picks Profit Maximizer Top 15%

Grade: B,C,D,E

Purpose: Debt consolidation, Other

Inquiries Last 6 Months: 0 or 1

Nickel Steamroller shows a ROI of 13.20% for notes originated in 2013, which is certainly inflated due to a low average age. If I assume the loans that have a status of in grace period or worse will be charged off, the ROI still comes in at 12.31%. I expect returns to be much lower and within the 10-11% range as stated by P2P-Picks.

Below is a screenshot of my Lending Club filter integrated with P2P-Picks.

My investment strategies have certainly changed over time, but I’m committed to sticking with P2P-Picks for 2015. My accounts will continue to age more quickly in 2015 than in the past since I don’t plan contributing much more to either account. At this point, I’m comfortable with my allocation to p2p lending.

I welcome any discussion on my investment strategies or for you to provide your own strategies in the comments.