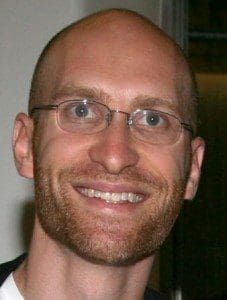

David Klein, the CEO and Co-founder of CommonBond is on a mission. He wants to not only shake up student lending, that has been renowned for its poor customer experience, he wants to create a company that gives back to the community as part of a larger social mission.

David Klein, the CEO and Co-founder of CommonBond is on a mission. He wants to not only shake up student lending, that has been renowned for its poor customer experience, he wants to create a company that gives back to the community as part of a larger social mission.

The story of CommonBond is a great entrepreneurial success story. David Klein saw a problem that needed fixing and created a company focused on fixing that problem. The team at CommonBond has executed very well, having raised large amounts of capital from people who agree that the problem of student loan financing does indeed need fixing.

In this podcast you will learn:

- How David’s bad experience with his own student loan led to the formation of CommonBond.

- The three pain points that David identified for students applying for a loan.

- The details of their pilot program at Wharton that launched in 2012.

- The kinds of loans that CommonBond is refinancing.

- The range of schools and degree programs they are focused on.

- The credit profile of the typical CommonBond borrower.

- Where CommonBond is today in terms of total loans funded.

- The typical interest rate reduction CommonBond borrowers enjoy.

- The popularity of the variable versus their fixed rate loan options.

- How and when they will serve their core borrower with new products.

- Who is funding the loans at CommonBond today.

- Why David likes the hybrid approach for the investor side of their business.

- Their approach to securitizations and details of their first securitization earlier this year.

- Details of their social mission and their Pencils of Promise program.

- What’s in store for CommonBond in 2016 and beyond.

Transcription Options

Download a PDF of the transcription of Podcast 49: David Klein of CommonBond.

[expand title=”Click to Read Podcast Transcription (Full Text Version) Below”]

PODCAST TRANSCRIPTION SESSION 49: DAVID KLEIN

Welcome to the Lend Academy podcast, Episode No. 49. This is your host, Peter Renton, Founder of Lend Academy.

Peter Renton: Today on the show, I am delighted to welcome David Klein. He is the CEO and Co-Founder of CommonBond who are one of the leaders in student lending. They have done hundreds of millions of dollars of student loan refinancing and they are very much focused on those students or those graduates who are really paying too much than they should on their student loans and they are a different kind of company. We’re going to get into that in the podcast. They have very much focused on doing more than just doing refinancing of student loans, they really want to make a company that makes a difference in people’s lives. Anyway, I hope you enjoy the show.

Welcome to the podcast, David.

David Klein: Thanks, Peter, great to be here.

Peter: So let’s just get started with giving the listeners a little bit of background about yourself, what you did before you started CommonBond and how that kind of led you to the founding of CommonBond.

David: Sure, so before CommonBond I spent time at McKinsey advising a few financial service clients. I also spent time in consumer finance at American Express.

With respect to the idea of CommonBond or the CommonBond origin, I think it’s important to know a couple of things. First is that I actually come from a family of entrepreneurs. In fact, I was the first in my family to ever work at a company. So I’ve said before, I was kind of the black sheep of the family having worked at places like McKinsey and American Express. I always knew I was going to go into the family business so to speak and start my own company, but I did want to spend about ten years in corporate America before I did that so to make a long story short, that’s what I did.

At about ten years, I decided, okay now is the time to go build a company. I decided to do that from business school, Wharton Business School, specifically, which is where…I really used that opportunity to incubate and accelerate an idea and the funny thing is it was precisely because I went to business school that I stumbled upon the idea for CommonBond in the first place.

I had to pay my way a hundred percent with student loans and in so doing, I discovered a few things. First, rates were unnecessarily high, especially for credit worthy borrowers. Two, the process was overly complex and three, the service was pretty poor. So having experienced that personal pain myself, having a background in finance as well as having entrepreneurial ambitions, I decided to commit myself to finding a better way and it was in that process while at business school I met my two co-founders, Mike Taormina and Jessup Shean. I invited them to join, they both said yes and I’ve been grateful for that.

Peter: Okay, so it’s an interesting story. Obviously you went to business school with the idea of starting a company one day, but I presume you had other ideas in mind. Did you start business school and you went through this process and suddenly think, this is just got to change or was it sort of a slow genesis where you, over time, realized that the system is not very efficient? Which one was it?

David: It was almost immediate. In fact, before I even started pre-terms at Wharton, I had already suffered the personal pain of student loans and identified these three areas across rate, process, and service that were really sub-standard to the point of me kind of identifying this as a broken market. So it was with that experience and understanding that I immediately decided to use the opportunity of business school to build upon the idea and build out the company from there. I ended up focusing a lot of my time on it. In fact, I wrote the business plan by around September/October 2011. At that point I had a business plan, but no co-founders. As I mentioned before, Mike and Jessup, they both joined and the rest, as they say, is history.

Peter: So you obviously stayed in school at Wharton for a while? I know, I think I read somewhere where you basically took your first summer and you just basically devoted it completely to the business and then…so you never went back, is that right? So you spent one year at Wharton and then you dropped out?

David: That’s exactly right. I spent pretty much full-time on the company even while in school, my first year, frankly…Mike and I then spent our summer between our first and second year dedicated to CommonBond, I ended up dropping out of Wharton to continue pushing CommonBond through. Mike ended up going back to Wharton, to the Wharton San Francisco Program at the time. He too, ultimately, dropped out and joined me in New York in December of that particular year. It was really around the time that we raised out first round of outside capital that we started really building the team from there, based ourselves in New York City, where we’re here right now, offices here in Chinatown, Manhattan.

Peter: So what was it like when you got going? When did you actually make your first loan and how did you get the money for that first loan?

David: Sure, so we launched a pilot program at our alma mater, at Wharton Business School in November 2012 and it was a $2.5 Million loan program. What we wanted to test was three things. One, borrower demand; two, investor demand and three, operational acumen of the team. If we could prove those three things out, we believe we can grow the right sinew growing and scaling. What we discovered in the pilot was the fact that there were three things. First, the borrower demand was there. In 24 hours of launch we had about $2.5 Million of loan applications.

Peter: Wow, so you filled up within 24 hours.

David: Within 24 hours so we said, okay, the demand is definitely there, one school in an off peak part of the cycle. Two was investor demand. We set out to raise one or two million. In loan funding, we had been raising $2.5 Million so, okay, the funding is there. Third, from an operational perspective we were off to disburse to the very last penny in a short period of time what we had raised and we did. So with that, we used traction, the momentum there and parlayed that into raising, at that time, what we believed needed to be $50 to 100 Million onto our platform in order to launch nationally.

To make a long story short, that was what we did. We ended up raising $100 Million onto our platform, we launched nationally in September 2013, almost two years ago, well over two years ago today and we’ve been growing our program ever since. We started in 20 MBA programs, we’re now in over 2,000 schools and universities at both the graduate and undergraduate level. We continue to grow over the past two years.

Peter: Okay, so you started off just doing refinancing of existing loans, is that correct? Is that still the primary focus?

David: Refinancing is the primary focus. We did launch with both a refinancing both the in-school MBA financing program, we still have the in-school MBA financing program in addition to refinance program across the country.

Peter: I just want to talk about that for a second. Student loan refinancing was unbeknownst to me that there really was no industry with student loan refinancing until the last few years. So what did people do….basically, let’s go back five years ago, to 2010, so no one refinanced student loans, you just basically…..you had your loan and you paid it and that was it, is that what it was like back then?

David: That’s right. It was pretty striking when you think about it. A few years ago student loan refinancing really didn’t exist with the exception of a validation program that the federal government run, but it was very limited. It was consolidation of multiple loans only. It wasn’t an ability to refinance to a lower rate, you simply put all your loans into one place to make it easier to manage and it was only for federal debt at that so there really wasn’t much of a market at all for refinancing. Of course, today that has changed, it’s a very large market. Student loans broadly is over $1.3 Trillion by now and as a broader industry probably no more than ….$5 to 10 Billion has really been refinanced over the past few years so it’s still relatively early days.

Peter: So what kind of loans are you refinancing? Obviously, you’ve got your federal student loans, you’ve got private loans. I mean, I know there’s all kinds of like…I can’t quite recall, ParentPlus or something, what are the loans that you are refinancing?

David: We’re refinancing both federal and private debt for the student borrower or graduate borrower. We also introduced the refinancing of current flat loans just last month. So this the notion that parents can borrow on half of their child to go to school for education, expenses, tuition, etc. and the parent that holds that loan once their student… graduates…. we now have a product whereby we can refinance that loan directly from the parent or for the parent.

Peter: Okay, so let’s just talk about the kinds of degree programs. You started off with MBAs and you started off with 20 schools and now you just announced a short time ago you’ve expanded to be on 2,000 schools. I mean, what is the typical borrower as far as their…what are they studying and is MBA still a major focus? Are there other degree programs that you are just as strong in? Where are you getting the borrowers and what sort of program are they in?

David: So because we started among the MBAs that our portfolio still leans heavier to the MBA side of things, but it’s closer to about 50% right now as opposed to 100%. The number continues to come down as we bring more degrees into the fold so that’s number one. Number two, our average borrower to date is 32 years old, they’re on average making six figures, employed, and have a FICO of north of 760. That’s what our borrower looks like today in part because of our upfront underwriting. What that has led to is a portfolio that will last a year that performs quite well.

Peter: Let’s talk about that, but I want to get this on the record as well. I mean, when you say “performed quite well,” I think you’re using an understatement. Just explain exactly how your portfolio has performed like as far as delinquencies and that sort of thing.

David: Sure, so in the two years now at national scale, we have not experienced a 30+ day delinquency let alone a default. So the performance, you know, as we talk about that…that is quite strong especially in an asset class student loan where you tend to see about 50% of all your default happening in the first two to three years.

So you think why is that, what’s going on, what’s so special about our platform and I think there are really two things going on. The first is our upfront underwriting and the things that we look at in order to underwrite our borrowers. The second is ongoing risk management processes. This is something that doesn’t get a lot of play in the industry or in conversations around underwriting or risk management, but it’s probably just as important as upfront underwriting. This is the idea that people today, your borrower base, you know who they are to the extent anyone ever finds himself in economic hardship, you know that somebody is one day late, there are a series of processes that we activate to ensure that repayment comes into line and we maintain a very strong record around…not just defaults, but also delinquencies.

Peter: So how many loans are we talking about then? I mean, what’s….I know you recently, I don’t know how long ago it was…..you just crossed over $100 Million in total loans issued, can you give us an idea of where you are today and how many loans we’re talking about:

David: Sure, we specifically talk about our numbers on an annual basis. So to your point last year, we surpassed a $100 Million loans funded.

Peter: Okay.

David: In 2015, we expect us to surpass half a billion loans funded and in 2016, we would expect to surpass $1.5 Billion in loans funded.

Peter: Wow, that’s quite a growth rate. So, today, you’re getting closer to that $500 Million mark, it sounds like.

David: That’s right.

Peter: And what’s a typical loan size?

David: Typical loan size is about $80,000 on the average over time.

Peter: $80…eight zero.

David: $80,000…eight zero, yeah.

Peter: Okay, and then what sort of…obviously, if differs. If someone is taking a private loan they could have a very high interest rate, but what is a typical interest rate reduction from someone who’s refinancing?

David: Sure, so the federal government plays a very role in student loans. In fact, they represent over 90% of all newly originated loans in the industry and what we see are a lot of borrowers who have federal debt and are holding 7 or 8% fixed all in APR. Meanwhile, these borrowers can refinance on our platform into a variable or fixed rate product that ranges between a high 1% to mid 6% and considering average folks are able to refinance with us for about 4 to 5% fixed, let’s call it, you compare that with the 7 to 8% fixed that they get through the federal government and it’s through that our borrowers on average are able to save over $14,000 over the life of their loan by refinancing with CommonBond.

Peter: Okay, so tell us a little bit about the variable loan that you have. Is that popular or do most people like the fixed rate?

David: Yeah, we do know that both are popular. Fixed rate is more popular than variable, but when we introduced the variable rate back in 2014, there was a pretty nice talk in demand that has pretty much sustained throughout and that’s just because there’s a group of folks who like the variable product. I think many of them believe that given where interest rates are right now as well as where they think interest rates might be over X number of years as a function of when they believe they can and should pay down their loan completely, some folks are taking the variable rate option and its the variable rate option where on the top of our platform as an example you are able to get something as low as the high 1% all the way up into the 4% zone and on a fixed rate, they are able to secure from CommonBond anything in the 3% plus to 6% plus close range.

Peter: Okay, so, obviously, you’re focusing on super prime borrowers when you said FICOs with 770 and above, I mean, that’s a really very strong borrower. Is this population going to be your focus moving forward because I imagine there’s a lot larger population when you go down to maybe mid 700s or low 700s which are still good strong borrowers. So are you trying to build your company just on the super prime borrowers or is there plan to expand?

David: There are a couple of things going on here. First, our program in open to folks below 700 even the high 600s so we’re not precluding people at that part of the credit spectrum. Number two, that being said, the part of the credit spectrum we’re playing in, high 600s all the way to 850, it just so happens to be bunching up. We’re averaging around the 760 to 770 range. As a matter of strategy, we do expect to continue serving this group of credit worthy borrowers with new loan products across variable and fixed across 5, 10 and 15 and 20-year terms as low as the hybrid loan product that we have. We’re the first in the industry to have a national scale and we have a 10-year product fixed for the first five years and variable thereafter. That’s what the term loan fixture looks like.

We also believe there are opportunities in serving our borrowers over their life cycle. So, it’s 32 years old, we have….we’re serving borrowers right now at the beginning of their personal life cycle, their financial needs continue to evolve. Many of them, after having gone through the experience, are asking us whether we can or will start offering other products in other asset classes and we believe for a while now that that makes a lot of sense when we think about the value of what we’re building as well as the reason we do what we do, it’s tied pretty much to the borrower than in one particular asset class.

We believe….we are well positioned to provide a peer product that is well priced, that heavily leverages technology and provides best-in-class at your service to our borrower not just to student loans, but also other potential product as their financial needs evolve. So I wouldn’t be surprised if in………before, you know, in 2016, you see from CommonBond a non-student loan product as our first foray into our product and asset class expansion.

Peter: So when you say non-student loan, do you mean like unsecured personal loan, like a Lending Club type offering or do you mean real estate? What do you mean exactly?

David: Yeah, I mean, the short answer is all of the above. The detailed answer is whether we believe is most important to our consumer given where they are in their personal life cycle and where are we best positioned to provide best-in-class product and service. So along those lines what we see is that…..we believe there is opportunity to move into unsecured personal credit and to serve that particular borrower who are in their 30’s, high FICO. They don’t necessarily have a lot of credit card debt floating at 20+% APR, but they do, based on the research we’ve done as well as the conversation we’ve had with them, have needs for personal credit and we will be able to respond and interestingly enough or as much as we talk about unsecured personal credit, our target borrower actually has been locally underserved as it relates to personal credit and is still under served as related to personal credit. The options they have right now, as we talk about credit card, not much of an option for them because the APR is way too high.

Traditional lenders don’t really want to offer or extend personal credit to that population. There are a number of platforms that currently exist around unsecured personal credit and I think are really doing a very good job for what they do serving the customer that they serve. But in terms of our customers there really aren’t too many options and so when we look at that, when we hear from our customers….hey, when you going to start offering personal credit and when we look at our operations, our platform, our underwriting, our brand, we think we’re well positioned to provide a superior product to our customers.

Peter: Okay, I want to switch gears onto the investor side of the equation.

David: Sure.

Peter: So who is funding your loans today?

David: Today comes from a wide variety of institutional investors, whether it’s a credit fund, big banks, small banks, asset managers, insurance companies that really run the gamut. I think what’s interesting is our capital strategy from the very beginning has really come in three flavors. We’ve always thought about capital strategy along three stages. The first was when we piloted a program at Wharton and we focused raising capital….you know, in order to raise capital we focused on individual accredited investors, actually alumni of Wharton, and that’s where we raised that first $2.5 Million. That was phase one.

Phase two was institutional capital and the reason we focused on institutional capital in phase two is because we wanted to scale the business within a reasonable amount of time so we decided to concentrate our sources of capital to institutional players and that’s the phase that we’re in right now and I’ll come back to that in a second.

And then stage three would be running both individual capital and institutional capital in parallel which is something that we expect to revisit if not this year, but expect to revisit nonetheless because we do think it’s important over time to diversify our funding sources.

Back to phase two of that long term capital strategy which is squarely where we are right now, two important things to know and that is the two sides of what we call our hybrid approach to funding. Our approach to funding is both balance sheet and marketplace. We started back about a year ago, we’re one of the first in the space to start that and I think we’ll probably have more of what we already have in the last year.

The reason for that is the following; on the balance sheet side, we define balance sheet as funding through warehouse lines and securitization and then we define marketplace lending as interested investors coming on to our platform and buying loans whole on a forward flow basis. The reason, I believe, is that hybrid approach is something that we’ll see more of for the reason that what you’ve seen in our platform works quite well. When you run both in parallel you have what we like to call a virtuous cycle whereby for every new securitization that we do, it’s another printed deal that the capital markets can look to to understand on the marketplace side for those investors and (inaudible) on the marketplace side and ultimately securitized and it gives them a public mark on what……not only what the deal will price at but what the underlying residual will likely be worth in a securitization.

The more visibility that investors have into the value of the residual, the more that’s the same as the premium over par that we charge investors on our financial marketplace in order to purchase the loan and hold them. Of course, the more securitizations we do, the more comfortable the market gets with us, the more the pricing on the senior bond starts to compress over time driving more value to the residual holder of the securitization.

Peter: Right, so……

David: Doing 100% balance sheet is the final comment to make is to do 100% balance sheet so this becomes quite capital intensive and to do only marketplace, we think, doesn’t give the platform the credit that it deserves and so being able to run securitization to drive full value on the marketplace side has been also introducing marketplace to ensure that we’re managing the capital, the equity capital, invested in the business appropriately over time, we think, running both parallel should be more of a virtuous cycle.

Peter: Right, right, so just talk a little bit more about that securitization piece because you completed your first one earlier this summer and it was rated investment grade, can you just describe a little bit about that process and is this going to be something that we see every quarter, every six months, what’s your plans?

David: Sure, so as you pointed out we did our first securitization in June of this year, 2015, that was our first and we expect to do a series of securitizations, I would expect us to do two securitizations in 2016, if not more. I think what’s interesting about that securitization…a few things. One, we had always planned to do a securitization in 2015; two, an opportunity to get an investment grade rating from both Moody’s and DBRS and three, it was the first time that the top three rating agencies, as far as we know, gave an investment grade rating to a first time issuer in marketplace lending. I think it signals a number of things with respect to not just our platform, but the growing space of marketplace lending that……you know, 2015 really is the year that marketplace lending is moving from the margin to the mainstream.

Our platform is really just a microcosm of that when you think about launching the marketplace with NelNet as our inaugural partner at the beginning of this year, bringing in of an industry veteran on board as our CFO and Morgan Edwards, the 25+ year veteran in finance who came over to us from Macquarie Bank, Morgan Stanley and other firms before that, the securitization spells the investment grade rating from Moody’s and DBRS, I think what we’re finding is that 2015 really is the year that marketplace lending breaks out. Of course, this is backed up by announcements throughout the industry consistently so throughout this year.

Peter: Okay, great, so before I let you go I want you to talk about something that is a little different from what you guys do and that is the Pencils of Promise Program you have. I’ve heard at some of your presentations at LendIt, you talked about CommonBond being……you know, it’s not just a finance company. You want to give back, you want to do more so can you tell us a little bit about this program and why you’ve set it up.

David: Sure, we have what we call our social promise and it really is our version of the One for One Social Mission and that is, for every degree fully funded on our platform, we fund the education of a student in need for a full year. We have partnered with Pencils of Promise, which is educational profit-based here in New York, to make that a reality. It’s effectively a program whereby our borrowers are not only able to get a superior product that is well priced to save them tens of thousands of dollars of the price of the loan and not only from a platform that heavily leverages technology to significantly simplify and speed up the process of getting a loan, but it’s also a way for our borrowers to use business and their business institution to drive social good and we merely enable that.

We enable that with this One For One social mission and we were the first in finance to bring that social mission to bear of this sort. We’re still the only……my hope is that changes as…..and I believe it will as more and more companies start to realize that the millennial generation in particular like to do business with companies whose values they share. All that being said, what I’m excited to mention is that we are actually taking a few of our borrowers to Ghana, to a chain of Pencils of Promise schools next week. We’re going to be seeing first hand a lot of the work that our borrowers have done by coming on to our platform in the first place that enabled us to help Pencils of Promise put a number of children in need through school.

So we’ll be taking a number of borrowers who secure their spot by responding to an essay contest. They were the best among all the answers we provided. We’ll also be taking a couple of CommonBond employees through the same process and so I’m pretty excited to go see the work of our social mission first hand here next week, but to your point, it is something that is a bit different. My hope and expectation is that social mission becomes more of the rule than the exception over time.

Peter: Right, that’s great. I mean, certainly will be a fascinating trip I expect. So last question, looking ahead to next year…I mean, this industry is moving very fast as you’re well aware, what are we going to see next from CommonBond? Is there going to be another big announcement soon or what’s on your plate for next year?

David: Sure, so as we think about 2015, it’s really about exceeding against the goals that we’ve laid out for ourselves, from an origination perspective I mentioned before, you know, going from $100 Million last year to $500 Million this year to roughly $1.5 Billion next year. From the employees’ perspective, we’ve always prided ourselves in doing a lot more with a lot less so the end of 2014, we had a little over 15 employees. By the end of 2015, we expect 60 employees and by the end of 2016, we expect to have over a hundred employees.

In terms of revenue, we expect to 7X our revenue this year. We expect to do something similar next year. We look forward to continuing our social promise and delivering a lot of social value through that as well. As I’ve mentioned before, starting to introduce other products outside of just student lending. There’s a lot to do in student lending and we’ll continue to do it, but adding more products onto our platform to better and more holistically serve our consumer which is something that we’re (inaudible) for is something that you can expect from us as well. I think that we continue to do that and to deliver to our customer the four things that ultimately matter to them which are innovative product that is well priced, that heavily leverages technology to simplify the process and deliver best-in-class customer service and we’ll continue to do what we’ve laid out to do from the very beginning and that is to build a great and lasting company.

Peter: Okay, well on that note I’ll let you go. I very much appreciate your time today, David.

David: Likewise, thanks, Peter.

Peter: Okay, see you.

David: Bye.

Peter: I just want to pickup on something that David said a few minutes ago and that is the fact that 2015, in his opinion, was a year that marketplace lending went mainstream. I think that’s true to some extent. I mean, if you talk to anyone on Wall Street today, people who were involved in managing billions of dollars in assets, most of those people now know about this industry, I would say. There’s been a real shift this year, but if you go outside of Wall Street into middle America you’re going to find a very different story. I think there is still a case where this industry doesn’t have the awareness that it should and that it will get one day. I think we’ve come a long way this year, but I’m looking forward to that time when I’m at a party and I talk about peer-to-peer lending, people go, oh, yeah, it’s great, what do you think about this, this and this. That still does not happen to me for the most part, occasionally. Most people I meet are still new and want to know more about it. I don’t really understand what’s going on with peer-to-peer lending, with marketplace lending. So we are trying to tackle that and we continue to do more on a daily, weekly, monthly basis.

On that note, I will sign off. Thank you very much for listening. I hope you enjoyed the show and I will catch you next time. Bye.[/expand]

You can subscribe to the Lend Academy Podcast via iTunes or Stitcher. To listen to this podcast episode there is an audio player directly below or you can download the MP3 file here.