Every quarter I give readers a look inside my p2p lending investments so everyone can see how I am doing. I do this in the spirit of transparency that this industry has been built on. I also want to be accountable to readers and demonstrate that I practice what I preach. I have been sharing these updates now for over two years – you can see all the previous reports here.

Overall P2P Lending Return Now at 11.85%

The final quarter of 2013 was a very interesting one for my p2p lending returns. My overall return is at an all time high but at the same time some of my accounts have struggled with defaults this past quarter. Since changing strategy in 2011 to a more aggressive portfolio my quarterly returns have steadily increased from around 8% to now almost 12%. While at the same time the average age of my overall portfolio continues to grow.

Below is the table showing a breakdown of my six accounts at Lending Club and Prosper.

[table id=49 /]

Here are a few points to keep in mind as you are looking at the above table.

- All the account totals and interest numbers are taken from my monthly statements that I download each month.

- The Net Interest column is the total interest earned plus late fees and recoveries less charge-offs.

- The Average Age column shows how old, on average, the notes are in each portfolio. Because I am reinvesting all the time this number changes slowly.

- The XIRR ROI column shows my real world return for the trailing 12 months (TTM). I believe the XIRR method is the best way to determine your actual return.

- The Return on Site number is obtained from the platforms on the last day of the quarter.

- Both Prosper and Lending Club provide investors with a more realistic returns number – at Lending Club it is called Adjusted Returns and at Prosper it is called Seasoned Returns so I am now including these numbers in my table.

- I do not take into account the impact of taxes.

Now, I will delve into each account in a little more detail and provide some commentary on the numbers in the above table.

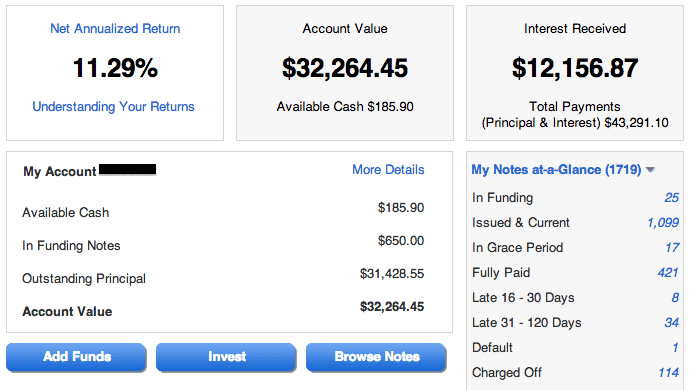

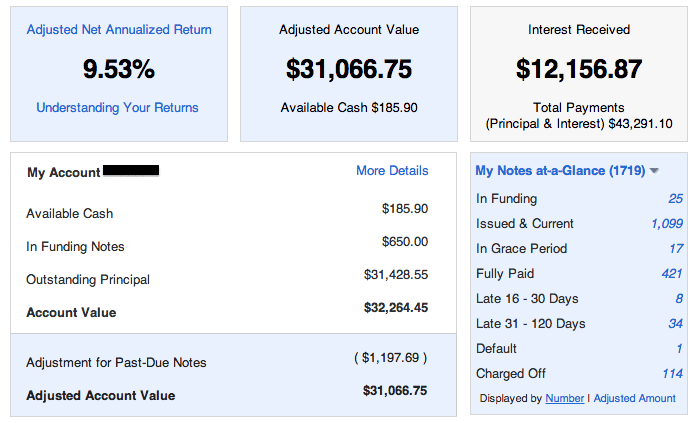

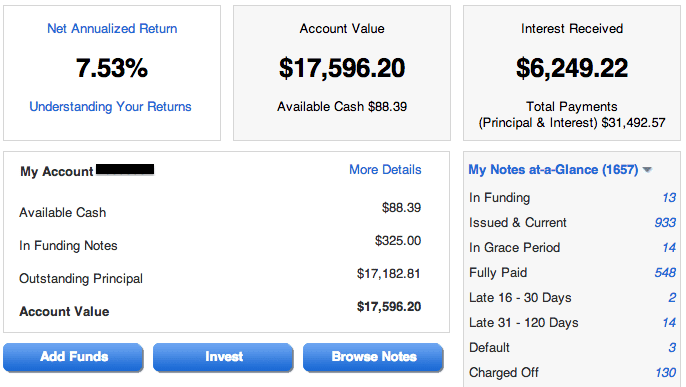

Lending Club Main

This is my taxable Lending Club account that was opened way back in June 2009. I originally invested $500 but soon added another $10,000 and over the years I have added an additional $14,000. So, my total investment has been $24,500 and it is now worth over $32,000. Astute readers may notice that the Account Value balance does not match exactly the closing balance in the above table. The reason for that is the screen shot above was taken two days into the New Year and so there are two extra days of payments reflected in the account value number in the screen shot.

While this account was started in a conservative way (focused on B and C grade loans), for the past three years I have been investing primarily in grades C-G. My average weighted interest rate is now 17.53% which is around a D-grade average. The returns on this account have been steady now for several quarters although I did see a bit of a drop in the last quarter due to a number of defaults.

Speaking of defaults I am also including the screenshot above showing the Adjusted numbers. This provides a more realistic look at the account and gives a better indication of expected future returns. For new accounts the difference between these numbers can be quite large – even with this old account there is a difference of 1.76%.

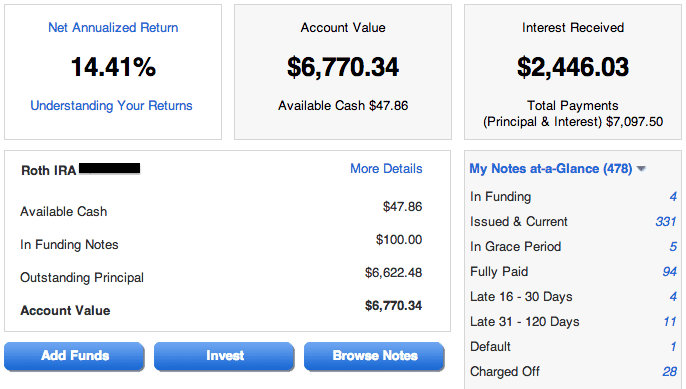

Lending Club Roth IRA

My Roth IRA is now almost three years old and with this account I have mainly invested in grades D-G. Although in recent months I have started adding an occasional C-grade loan into the mix. It still has the highest weighted average interest rate of all my Lending Club accounts at 19.01% and has the highest return according to Lending Club. But my actual return of 11.49% with this account of is considerably lower than the Net Annualized Return numbers. This is due to the difference between my calculation and Lending Club’s. I am looking only at the previous 12 months for my calculations whereas Lending Club is looking at the average return over the life of the portfolio.

I was pleased to see a rebound in this account last quarter as my real ROI had been dropping steadily for quite some time. I will be adding another $5,000 to this account before April 15.

Lending Club Traditional IRA

This is my wife’s traditional IRA that was opened in April 2010 after rolling over a couple of different 401(k) accounts into Lending Club. At the time I opened it as a PRIME account and let Lending Club invest in a moderately conservative portfolio. But about two years ago I took the account off PRIME and began managing it myself. I have been quite aggressive with this account taking it from a weighted average interest rate of 12.3% in 2011 to 16.85% today.

This account has been the star in my portfolio in the last quarter. With a 13.88% TTM real return this was by far my best performing account. Since making the change to a more aggressive approach my returns have continued to increase every quarter. To give you some perspective when I took this account off PRIME my real return was 6.99%. I have pretty much doubled that return in two years. Now, I expect this is the high water mark for this account – I have a lot of late loans that will end up defaulting in this coming quarter.

Lending Club Roth IRA – 2

This is my wife’s Roth IRA that was also rolled over to Lending Club in April 2010. This has been the conservative account in my portfolio – for over three years I let Lending Club invest in a moderately conservative portfolio. But I decided I was leaving money on the table by not being more aggressive with this account so I took it off PRIME and began investing primarily in C and D grade loans. It is still not as aggressive as my other accounts but I expect to slowly increase my returns here as the higher interest loans become a bigger part of my portfolio.

One interesting note about this account. While I took this account off PRIME in July last year, with the new and enhanced PRIME I have turned PRIME back on. But I am using PRIME to run an automated search for my Super Simple criteria and it is doing a decent job of staying fully invested. Interestingly, it is placing orders pretty much every day which is far better than the old PRIME that would only run orders once or twice a month.

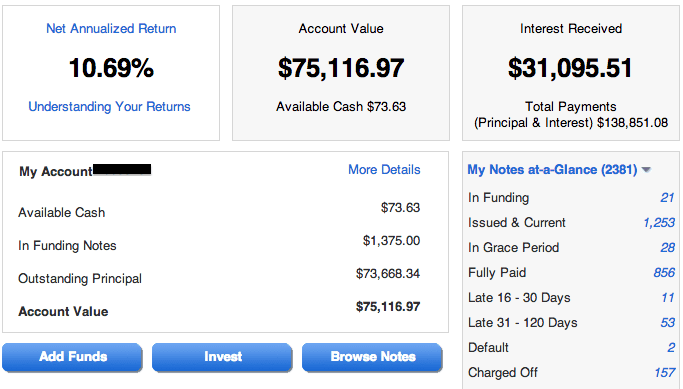

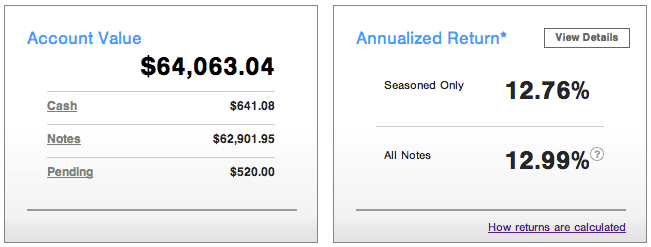

Prosper Main

My first Prosper account was opened in September 2010 and I have invested exactly $50,000 into this account since then. Pretty much from day one I focused on high interest loans on this account and today I have an average interest rate of 23.58%. With these higher risk borrowers comes the likelihood of more defaults. This account has been focused on the C, D and E grade loans at Prosper and my ROI has been steadily dropping as my account ages which is to be expected. At an 11.69% real return I am still quite happy with the returns here although I would like to get back over 12%.

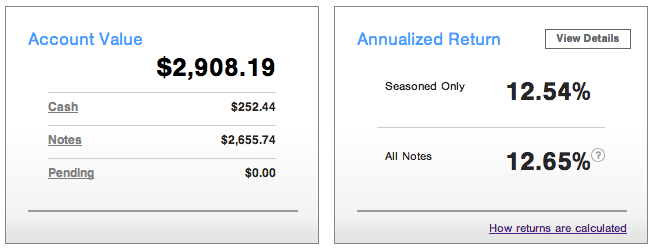

Prosper – 2

My smallest account is also my most volatile. With just 136 notes notes invested this account is most susceptible to the impact of defaults. This was very apparent in the most recent quarter. It was just six months ago that this account had a real world return of 15.87% – this has dropped dramatically now to just 8.14%. With an average interest rate of 27.7% this is also by far my most aggressive account so I should not be surprised that it is so volatile. My total balance this past quarter actually dropped for the first time as I received more defaults than interest earned in the previous three months.

The situation has been exacerbated by the fact that my Automated Quick Invest has failed to find enough of the high risk loans. I have decided to pull back somewhat on the aggressive nature of this account that has been primarily invested in E and HR grade loans. I am going to include a few more C and D grade loans from now on.

Final Thoughts on My P2P Lending Portfolio

My results in the fourth quarter of 2013 were the best ever – at an 11.85% TTM return I am very happy with how things have been going. But I also think this number will remain as the high water mark for my returns. I am going to slightly adjust my approach this year to be a little less aggressive – going forward I will be introducing a few more C-grade loans at Lending Club and B-grade loans at Prosper. Why? For two reasons. One, I think it will add more diversification to my portfolio and therefore reduce the volatility. Two, it will give me more loans to choose from as I put new money to work.

Speaking of new money. I am finally opening up a Prosper IRA. As I have said before I am no longer adding any new money into my taxable accounts – all new deposits will be in retirement accounts. I have already started the process of rolling over $50,000 into a Prosper Roth IRA. I will also be adding to my Lending Club Roth IRA for the 2013 tax year. You will read more about these new deposits in coming weeks.

Finally, as I always do in these updates I like to emphasize the Net Interest number. This represents the actual gains from the account. My total net interest continues to increase and at $21,000 now, the bulk of which is tax free, it could provide a nice income if I chose to start withdrawals.

Let me know what you think. I am happy to answer questions and respond to your comments about any of my p2p lending accounts. I look forward to hearing from you.