Every quarter I take some time to share how my p2p lending returns have been doing. I open the kimono and take you inside my Lending Club and Prosper accounts to share my returns. I do this because I believe in transparency and I want people to see how returns can change over time.

I have been sharing these returns since 2011 and this quarter marks the 12th edition of this returns post. You can go back and look at all these quarterly reports to see how things have changed over time for me.

Today, all of these accounts are on autopilot. While I used to pick loans by hand back in the early days I like the passive approach today. I know there are many Lend Academy readers who prefer an active approach and are logging in every day to invest or are selling notes regularly on the Folio trading platform.

While I agree it is possible to earn higher returns doing that I am quite comfortable with the returns I make particularly when I consider that everything runs in an automated fashion. Today I used Nickel Steamroller for most of my investing although I do use Lending Club’s own automated tool for one of my accounts and Bluevestment with P2P Picks for another.

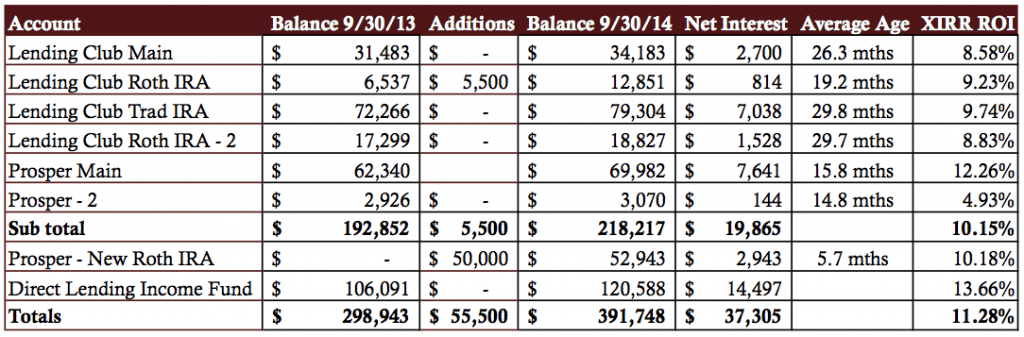

Overall P2P Lending Return Now at 11.28%

Before I get into the details of my returns I want to give a quick overview for newcomers. I have had six accounts, four at Lending Club and two at Prosper for several years. These accounts have formed the core of my p2p lending portfolio and their results can be tracked back to the fourth quarter of 2011. Recently, I have added two new accounts into the mix. In February I opened a Prosper SMA account through Lend Academy Investments, my new wealth management firm, and last year I invested in the Direct Lending Income Fund, a fund that invests in small business loans.

Below is the quarterly table of all my p2p lending investments. I have continued to separate these two new accounts from the six established accounts – mainly so I can continue to track the overall returns of these core accounts. Speaking of which, my returns declined again for my core accounts as defaults continued to increase, my overall return for my core accounts went down from 11.15% to 10.15%. This marks the second consecutive quarterly decline for both my core accounts and my overall return which stood at 11.28% as of September 30.

Click on the graphic below to see the full size chart.

As you look at the above table you should take note of the following points:

- All the account totals and interest numbers are taken from my monthly statements that I download each month.

- The Net Interest column is the total interest earned plus late fees and recoveries less charge-offs.

- The Average Age column shows how old, on average, the notes are in each portfolio. These numbers are obtained from the platforms.

- The XIRR ROI column shows my real world return for the trailing 12 months (TTM). I believe the XIRR method is the best way to determine your actual return.

- The two new accounts have been separated out to provide a level of continuity with my previous updates.

- I do not take into account the impact of taxes.

- The extended chart showing returns displayed at Prosper and Lending Club as well as my adjusted returns can be viewed here.

Now, I will delve into the details on each of my accounts. I am also going to refer to my investment strategy for each account, so you will need to read my How I am Investing in 2014 post to be able to follow along.

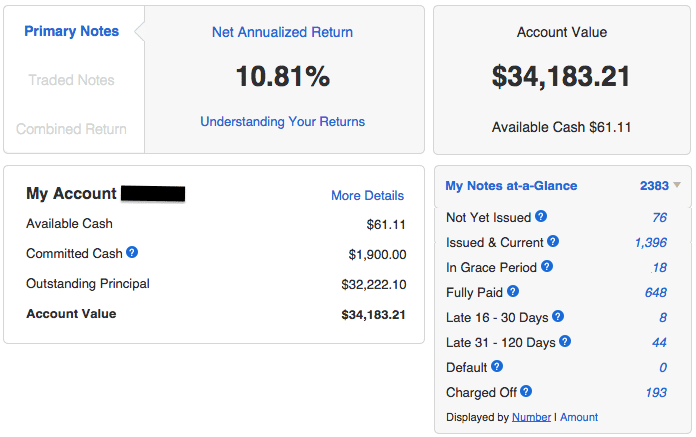

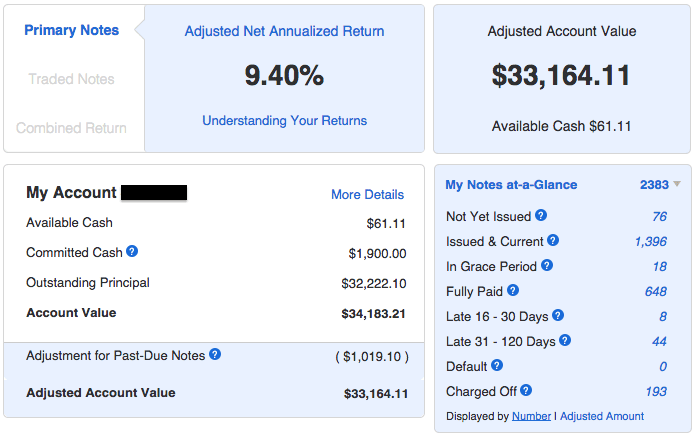

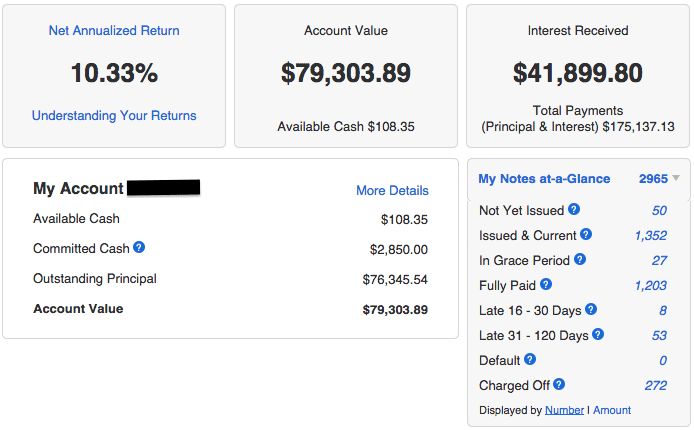

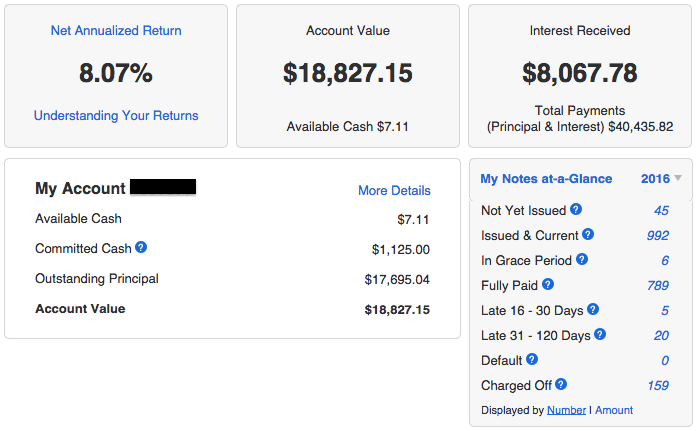

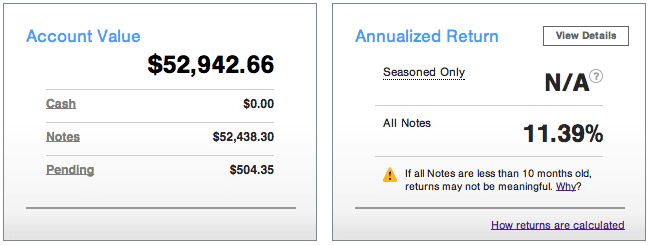

Lending Club Main

This is my original account opened at Lending Club in June 2009. With this account I am providing you with two screen shots. The above graphic shows my Lending Club account and the regular Net Annualized Return while the graphic below shows my adjusted return and account balance. You can see that I have 52 late loans in my portfolio resulting in my adjusted return being 1.41% below my actual NAR. Both these numbers overstate my trailing twelve month (TTM) XIRR return of 8.58%. I use the P2P-Picks Profit Maximizer with Bluevestment to invest in this account.

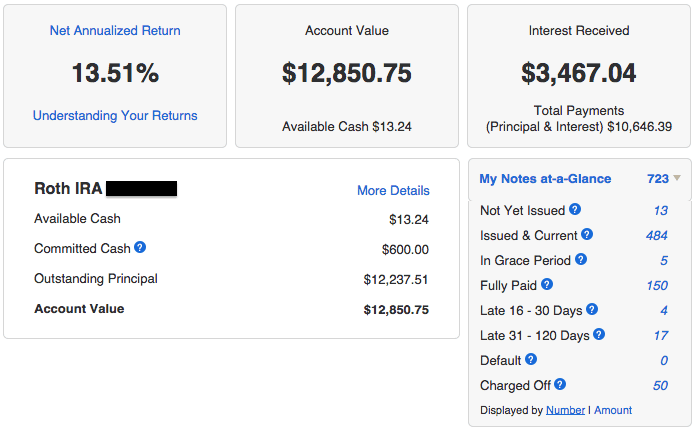

Lending Club Roth IRA

If I had to pick a favorite of all my Lending Club accounts it would be this one. I opened this account with $5,000 three and a half years ago and I have only ever invested in high yield loans. While my NAR remains high at 13.51% my TTM return has stayed below 10% again this quarter. I have been using Lending Club Filter 1 to invest.

Lending Club Traditional IRA

This has become my best performing Lending Club account although the XIRR returns have dropped below 10% for the first time in 18 months (this account used to invest in B and C grade loans). To give you an idea of how quickly defaults can impact returns in the last three quarters my TTM return has gone from 13.61% to 11.91% to 9.74%. I expect it will stabilize here in the 9-10% range from now on. I have been using Lending Club Filters 2 and 3 to invest.

Lending Club Roth IRA – 2

The TTM return for this account continues to rise. I migrated to a more aggressive approach with this account a little over a year ago and the returns have reflected that. My TTM return bottomed out at 4.91% in Q4 of 2012 and have now increased to 8.83% on par with the rest of my accounts. I am using Lending Club’s automated investing process with this account using my Super Simple filter.

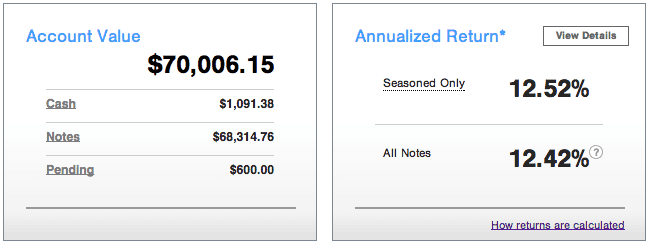

Prosper Main

The third quarter saw this account celebrate its fourth birthday. As has often been the case since I started sharing my results in 2011 this account has seen the best returns of my Lending Club and Prosper investments. I am very pleased that I am able to maintain over a 12% XIRR return with this account. I primarily use my Prosper Filter 2 to invest.

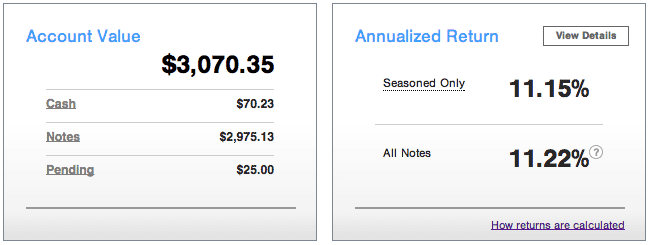

Prosper – 2

This has always been my most aggressive account. Focusing on E & HR loans it has the highest weighted average of all my accounts (25.5%). Despite that, or more accurately, because of that, my returns are now anemic. The TTM return has now dropped below 5% as defaults continue to wreak havoc on this moderately diversified account. Today, I am investing a little less aggressively using my Prosper Filter 3 (Super Simple).

Prosper – Roth IRA

With all my accounts investing aggressively I opened this account earlier this year with the intention of maintaining a more conservative approach. I rolled over $50,000 from my Roth IRA and I have my own firm, Lend Academy Investments, manage this account with our balanced portfolio. It invests primarily in A, B and C grade loans at Prosper using our own models.

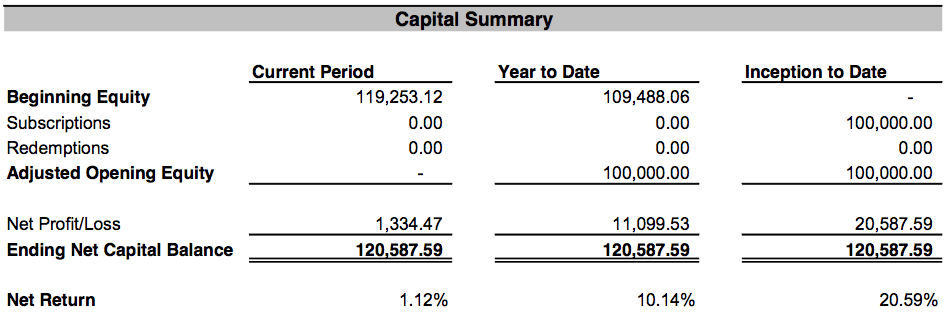

Direct Lending Income Fund

My investment in Brendan Ross’s Direct Lending Income Fund continues to perform very well. This is a completely passive investment with Brendan doing all the work selecting loans. I have now been investing for almost 18 months and continue to enjoy the best returns of any of my p2p investments.

Final Thoughts

My second consecutive decline in returns is somewhat disappointing to me. My defaults are going up while at the same time my weighted average interest rate is going down due to the declining interest rates at both Prosper and Lending Club. Whereas a year or two ago it was relatively easy to maintain a double digit return even with a mature account that is not the case today. I am going to be doing a thorough review of all my accounts here in the next month or so to see what I can do to stabilize my returns.

One final note. Every quarter I like to highlight the one number I consider to be the most important – that of Net Interest earned. This is the money that shows the real gains in your account (before taxes). I am pleased this number has grown a great deal over the past year and now stands at $37,305 in the last 12 months. That number has risen every quarter since I started investing in 2009 and I want to see that continue to happen.

I am always happy to hear what you think – please share in the comments section below.