The following article is the second of a two part series by Matt Shibata, CFA, looking at P2P lending as a fixed income asset class from the perspective of an investment professional. The first article is here. Matt is a Portfolio Manager at Morling Financial Advisors. He invests in P2P loans via retail channels and advises clients who invest in P2P (and other asset classes) via institutional channels. Matt writes on investment topics at his blog ThoughtfulFinance.com.

Credit Risk

Just as Michael Milken found that junk bond rates in the 1980’s were sufficiently high to buffer against the losses from defaults, I see the same favorable dynamic in P2P lending today. P2P has higher rates, defaults, and total returns than many other types of fixed-income today. Drilling down within P2P lending, we find that higher-grade notes have fewer defaults, while “riskier” notes have higher returns (again, because the higher rates are more than sufficient to cover the losses from higher defaults).

While some commentators may dismiss P2P as an asset class, due to the higher default rates, we know that price (or yield) is the arbiter of risk and so we need to examine whether P2P compensates investors for the risk taken. Whether we define risk as an unknown outcome or the probability of loss, we need to quantify it. For simplicity’s sake, lets run a portfolio of notes through several scenarios.

Best Case: We could assume the status quo continues, which is to say consumer finances are improving and defaults remain low. Loss-adjusted returns may average 4-5% on a high-grade portfolio, 8-9% for a broad-based portfolio, and 11-13% for a low-grade portfolio.

Worst Case: In a worst-case scenario, á la 2008-2009 recession which saw unemployment surge and consumer balance sheets decimated, we learned a couple of things. If you look at data on all Lending Club notes, as well as independent analysis on sites like NickelSteamroller.com or LendStats.com, the only year in which total originations had a negative return was 2007. Of course, there was some pretty horrific performance out of loans originated during the fall and winter of 2008-2009. I do not have space to detail the composition, timing, and other more granular aspects of the recession performance, but this data can easily be pulled from the aforementioned sources.

Prosper notes had significantly worse losses during the recession, although I believe much of this is attributable to their early practice of allowing participants to set rates. This taught us that skilled and professional underwriting is essential to maintaining the integrity of P2P product. Furthermore, it supports (but does not prove) that originator-set rates/prices ensure P2P investing is a profitable experience.

Anyone can create their own stress-test by assuming higher default rates, but I am content to use the historical stress-test of the 2008-2009 recession. I should mention that it would be prudent for anyone using a historical or hypothetical stress-test to take into account the many changes made on Lending Club’s platform since 2007, some of which may improve returns and some which might reduce them.

Similar to interest rate risk, the credit risk of P2P loans compares favorably with other fixed-income assets. It is possible the US could experience another recession, perhaps even a deep one. If you only buy the riskiest notes during the worst months, you are definitely hosed (that’s a sophisticated institutional term). However, this would be hard to do even if you tried; if you diversify across grades and vintages, P2P is an attractive asset class.

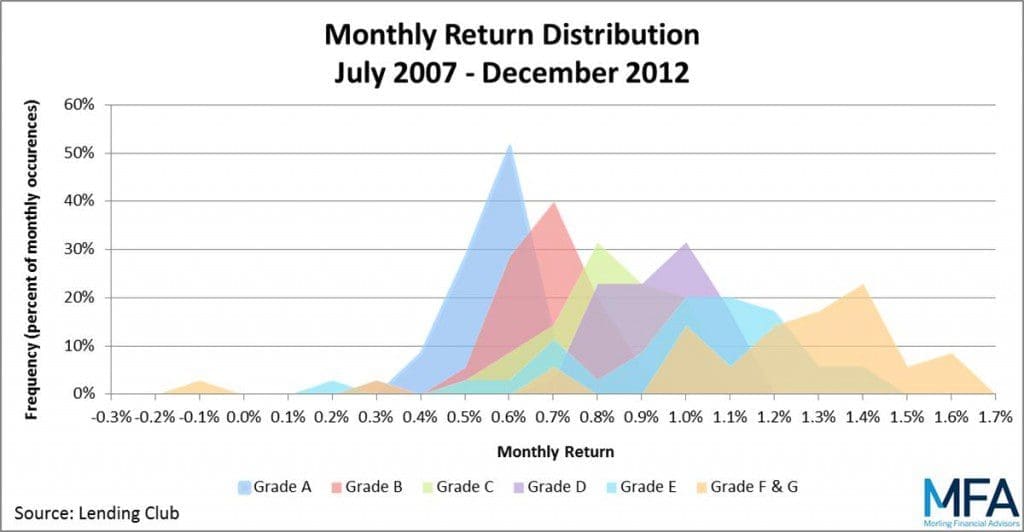

Below are the monthly return distributions of all Lending Club notes, since inception, sorted by grade:

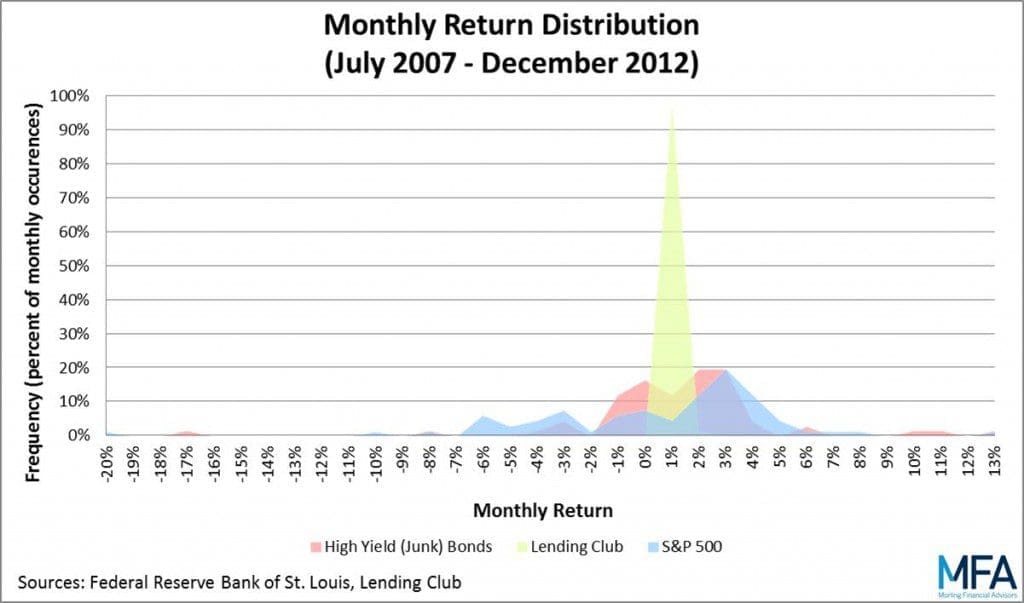

And here are the monthly return distributions for all Lending Club loans, since inception, relative to high yield bonds and the S&P 500 over the same timeframe. Notice the x-axis scale when comparing the two charts…

One last consideration is to understand where your credit risk exposure is. Typically, an ABS sponsor establishes a separate entity, called a special purpose vehicle (SPV), to buy and hold the loans and issue securities to investors. The SPV is considered “bankruptcy remote” from the sponsor, which means the loans are protected should the sponsor go bankrupt.

Prosper has established an SPV, called Prosper Funding. Prosper Marketplace (the service side) originates the loans, transfers them to Prosper Funding, who then issues the notes to investors. So investor assets are held in Prosper Funding, which is distinct from Prosper Marketplace; thus, in a hypothetical Prosper Marketplace bankruptcy, creditors should not be able to recover the loans/notes from investors.

Lending Club, on the other hand, holds the loans/notes on its balance sheet. According to the most recent prospectus, if Lending Club went bankrupt, then note holders would be considered unsecured creditors of Lending Club (not of the borrowers). Basically, investors are lending money to Lending Club, who originates and owns the loans and promises to pass the principal and interest payments back to the investors. So investors do not technically own the notes, as Lending Club states in its prospectus, and it is important to note that you are ultimately exposed to Lending Club’s credit risk (as well as the borrowers’). Given the current financial position of Lending Club, I am not too concerned about the lack of an SPV, but it is worth mentioning and investors should monitor Lending Club’s balance sheet regularly.

Interest Rate Risk

Since all P2P loans are short-term (3 or 5 years), are fully amortizing, and have relatively high coupon rates, duration (a measure of interest rate risk) on any given note is extremely low. I believe that the duration for any given note may even overstate many notes’ price sensitivity to interest rates, since the secondary market is not yet mature. It would be interesting to analyze Foliofn data for the past two months and see if secondary market prices dropped significantly in response to the rally in rates. Regardless, the interest rate risk is miniscule, which is ideal for times like these.

However, even if price fluctuations from rising rates are minimal, owning fixed-income in a rising rate environment creates an opportunity cost. This is because the rates on new loans will be higher than the rates on the loans you own. While I have read some research showing that 36-month loans have less credit risk than 60-month loans, I have not seen anyone mention the fact that there is a much lower opportunity cost to holding a 36-month loan, should interest rates rise. If rates rise, I assume the P2P originators will raise their lending rates. A shorter loan term will return your principal more quickly, which means you can reinvest it at higher rates sooner. Lastly, like many asset-backed securities (ABS), P2P loans have an average life that is shorter than their stated maturity, due to the borrower prepayment option. This further reduces the opportunity cost if rates rise (although this would be called “call risk” in a falling rate environment).

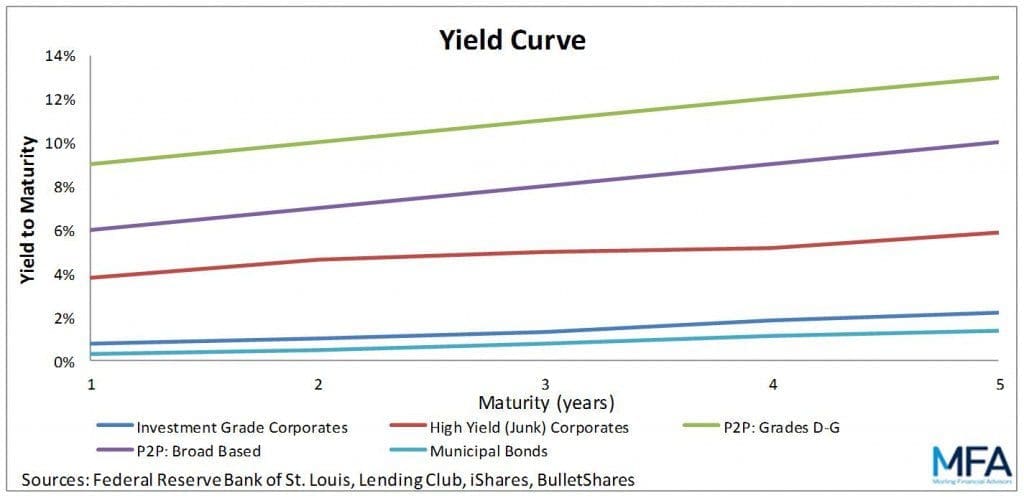

Looking around the rest of the fixed-income market, we find 2-year Treasuries yielding .26%, most 2-year investment-grade corporate bonds below 1%, and 2-year high-yield corporates in the 4-5% range. A 36-month P2P note has a similar duration to a 2 year bullet bond, but offers a much higher yield than all of these:

P2P Risks

Beyond the risks common to all fixed income, the two P2P-specific risks I see involve the withdrawal of P2P’s competitive advantages: solid underwriting/risk-management and originator-set rates.

As we saw with investment bankers during the dotcom bubble and mortgage bankers during the housing boom, it is always dangerous to incentivize the origination of investment products, especially if the originators do not intend to hold product on their books. Although the P2P originators collect a 1% servicing fee, the majority of their revenue comes from loan origination fees. It is important to recognize this fact and monitor any changes to the underwriting standards.

Secondly, as noted previously, the fact that the originators are setting the prices/yields and shielding the offering prices from market prices mean that excess returns are available. If this changes in any way, I would be very cautious as this is the crux of the P2P value proposition.

Conclusion

In summary, I do think P2P is a viable fixed-income asset class, with a unique advantage over similar ABS and high-yield debt. Given current dynamics, I think most fixed-income portfolios should include an allocation to P2P loans. Interest rate risk is almost non-existent and there is more than enough yield to cover the credit risk, except under the most dire scenarios. That said, I believe the asset class proved itself through the recent recession, relative to other debt. Investability (especially in size) remains an issue, although that is another blog post. Nevertheless, for this reason, P2P investing is an asset class in which individual investors can outperform the larger institutional investors due to the small size of the current P2P market. Of course, I suggest they borrow some of the tools from traditional fixed-income investment management to refine their strategies.