This morning OnDeck announced their second quarter 2017 earnings. In addition to the earnings release and webcast, we were able to speak with OnDeck CEO Noah Breslow today to get additional perspective on the financials and the news they shared.

The big win for the quarter was that they have expanded their partnership with JPMorgan Chase by up to four years. When we spoke to Breslow he wasn’t able to provide much additional detail about the partnership but he did say that the credit performance of these Chase loans has met or exceeded expectations. He also said that the initial structure of the relationship is still in place in their new deal.

The other interesting tidbit Breslow shared was around the SMART Box. The SMART Box was announced in October 2016 by the Innovative Lending Platform Association (ILPA) and it has been part of all OnDeck loans and lines of credit for several months now. He said that Chase has also adopted the SMART Box in all the loans originated in their OnDeck partnership, so having the Chase stamp of approval is a big positive for this new initiative.

In the Q&A section of the call Breslow teased that there may be an opportunity to expand the reach of the product beyond Chase customers. Although he wouldn’t elaborate further it’s safe to say that there is much more opportunity to grow both the product offerings and the target market. Not surprisingly the Chase book is lower risk compared to OnDeck’s book and they have increased the maximum loan size from $100,000 to $200,000. The net promoter score of the product remains high at 84. OnDeck provided the below screenshot of how the Chase offering is presented to prospective borrowers.

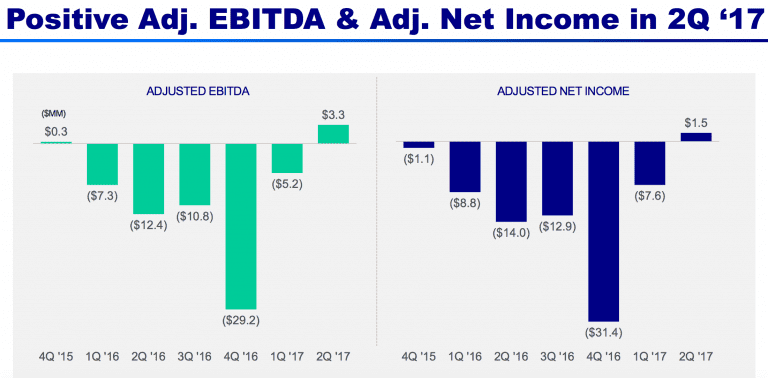

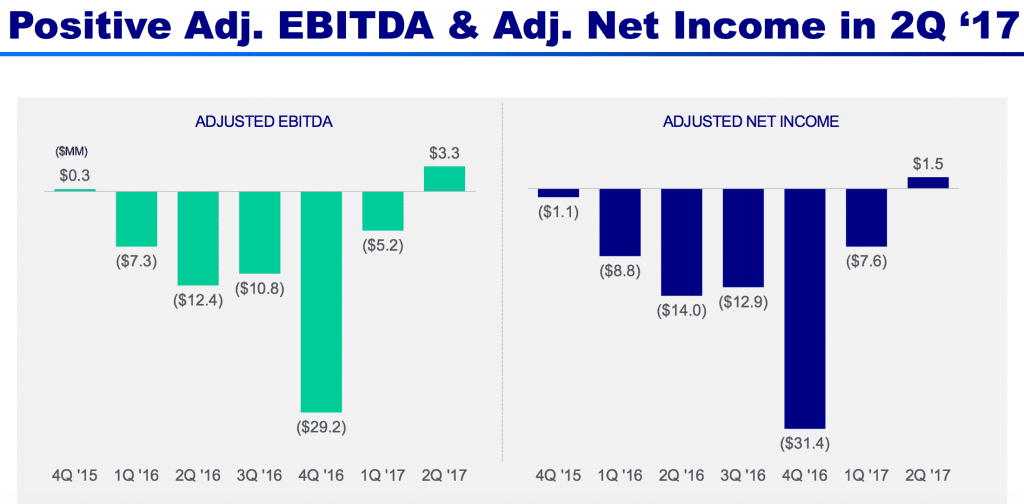

On to the numbers from the Q2 earning report. OnDeck loan originations fell to $464 million down from $590 million in Q2 2016 as the company continues to tighten their credit policy. Gross revenue increased to $86.7 million, up 25% year over year. Loans sold or designated as held for sale on OnDeck’s marketplace fell to just 2.3%, continuing the trend of OnDeck holding more loans on their balance sheet. Adjusted EBITDA was $3.3 million for the quarter, up from a negative $12.4 million in the prior year period.

Last quarter we reported that the company was seeking to achieve GAAP profitability by the end of the year, something that they would have achieved this quarter but for the one-time $3 million of severance charges. Breslow noted that the company is on track to return to sequential originations growth in the third quarter. Below is a look at OnDeck’s EBITDA over the last seven quarters showing the progress they have made.

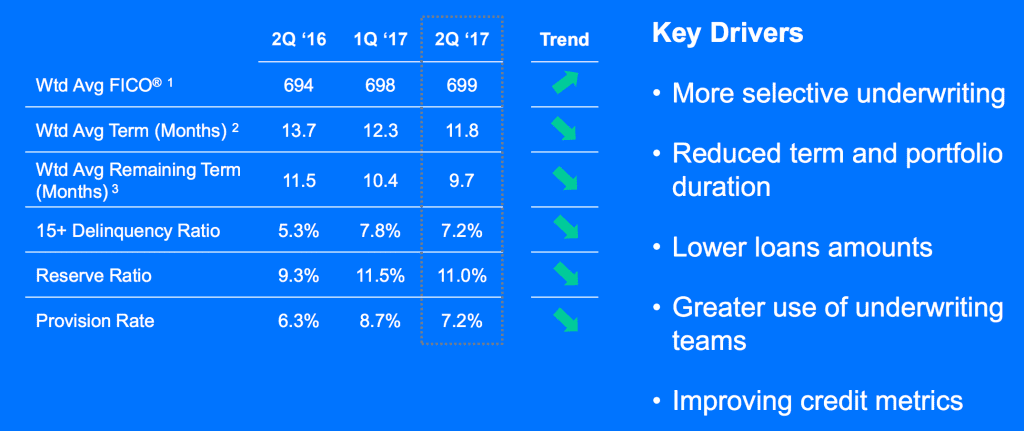

On loan performance Breslow stated that the second quarter brought some of the highest quality borrowers that the company has ever originated and that OnDeck is in a substantially more stable credit position than it was 6 months ago. Below is a look at their loan book over the past three quarters.

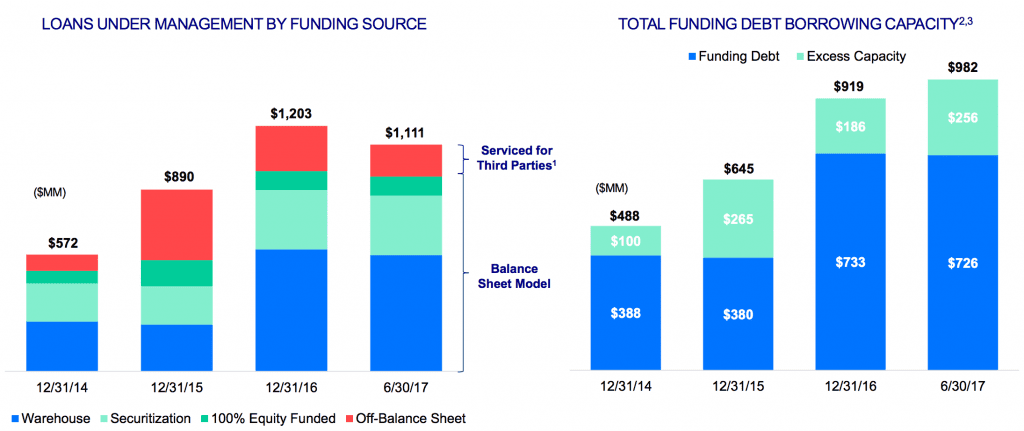

OnDeck made several changes to expand their funding capacity which is an important part of the business given the shift to holding more loans on balance sheet over the last year. They extended the maturity date of a $100 million credit facility provided by SunTrust bank to November 2018 while also reducing funding cost by 50 basis points. They also extended the maturity, and borrowing capacity of their asset-backed debt facility which finances the line of credit product while also decreasing funding costs by 200 basis points.

Breslow mentioned that customers are excited about OnDeck’s line of credit product, but the company has had their foot on the brake due to funding sources as they prove out the performance of the product. In 2018 and 2019, the line of credit product could be a much bigger part of the business.

Conclusion

When you compare the OnDeck of one year ago to today it is a very different company. They have shifted their business model and the company is now on a much better footing financially. Breslow said that OnDeck is now on the other side of the challenges they faced and they are starting to build traction with a new financial profile. What will be interesting to see in the next few quarters is if the company can grow originations while continuing to extend credit to the quality borrowers that they seem to be funding today.

[Disclosure: Peter Renton, the founder and CEO of Lend Academy, owns ONDK stock.]