On OnDeck’s Q4 2016 earnings call we learned that the company was cutting 11% of its staff resulting in $20 million in savings. At the time, OnDeck shared plans to become positive adjusted EBITDA profitable in 2017 and GAAP profitable in 2018. The company is now accelerating those plans which we learned about in today’s earnings press release.

As part of our continued commitment to drive efficiencies and reduce OnDeck’s operating expenses, we are implementing an additional $25 million of annual run rate operating expense savings relative to our year-end 2016 exit run rate.

The company is now targeting GAAP profitability in the second half of 2017 with the increased cost cutting. The cost savings will come primarily from a workforce reduction in the second quarter. At the end of the second quarter headcount will be 27% less than the headcount was on December 31, 2016.

Originations for the first quarter were $573 million, down from the previous quarter of $632 million and up 1% from the prior year period. This is a result of the company’s credit tightening that was implemented during the quarter. OnDeck is not only being more selective on who they approve, but is also making more conservative offers, focusing on smaller loans with shorter terms. The company noted that they exited the quarter with a lower risk profile than they started the quarter with. While originations fell, OnDeck shared that the first quarter brought the second highest loan applications to date. Loan volume for 2017 is projected to be less than 2016.

Other financial highlights for the quarter include:

- Gross revenue of $92.9 million (up 48% from the comparable prior year period) driven by higher interest income.

- Gain on sale revenue of $1.5 million (down 79% from the comparable prior year period).

- Net revenue of $35.4 million (down 13% versus the comparable prior year period).

- GAAP net loss attributable to On Deck Capital, Inc. common stockholders was $11.1 million, or $0.15 per basic and diluted share.

- Adjusted EBITDA was negative $5.2 million (versus negative $7.3 million in the comparable prior year period).

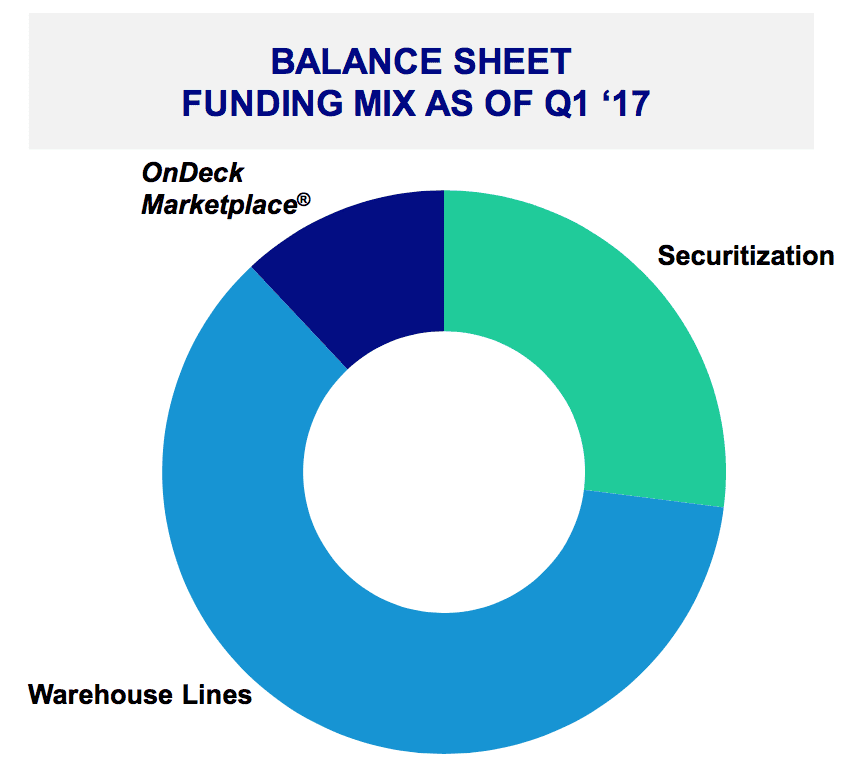

For several quarters now I’ve been writing about how OnDeck has shifted its business from selling loans on the OnDeck Marketplace to holding loans on their balance sheet. In the past I have viewed this as a necessary move for the company due to falling investor demand. However, it seems now this may be the long term strategy for the company. Going forward OnDeck anticipates less than 5% of term loan originations to be placed on the OnDeck Marketplace. This is despite CEO Noah Breslow’s comments in the earnings call stating that investor demand had improved in the quarter. From the press release:

To optimize long-term financial performance, OnDeck plans to reduce the percentage of term loan originations sold through OnDeck Marketplace to less than 5% for the remainder of 2017.

Loans sold or designated as held for sale through OnDeck Marketplace represented 9.0% of term loan originations in Q1 2017, down from 15.8% in the prior quarter.and Noah Breslow noted that the liquidity benefit of selling loans on the marketplace is much less important. The company has $1 billion of funding capacity and ended the quarter with $73 million in cash and cash equivalents.

Conclusion

While an additional workforce reduction is tough to swallow it seems like this is the right decision for OnDeck to ensure its long term success. OnDeck has been under pressure from outside stakeholders such as Marathon Partners to explore changes to the business. There were also rumors that competitor Kabbage was looking for acquisition targets and OnDeck could be one of them. No one knows what the future holds for OnDeck but the company certainly will be in a better position once it becomes profitable.

You can listen to the conference call and view the earnings presentation on OnDeck’s website.

[Disclosure: Peter Renton, the founder and CEO of Lend Academy, owns ONDK stock.]