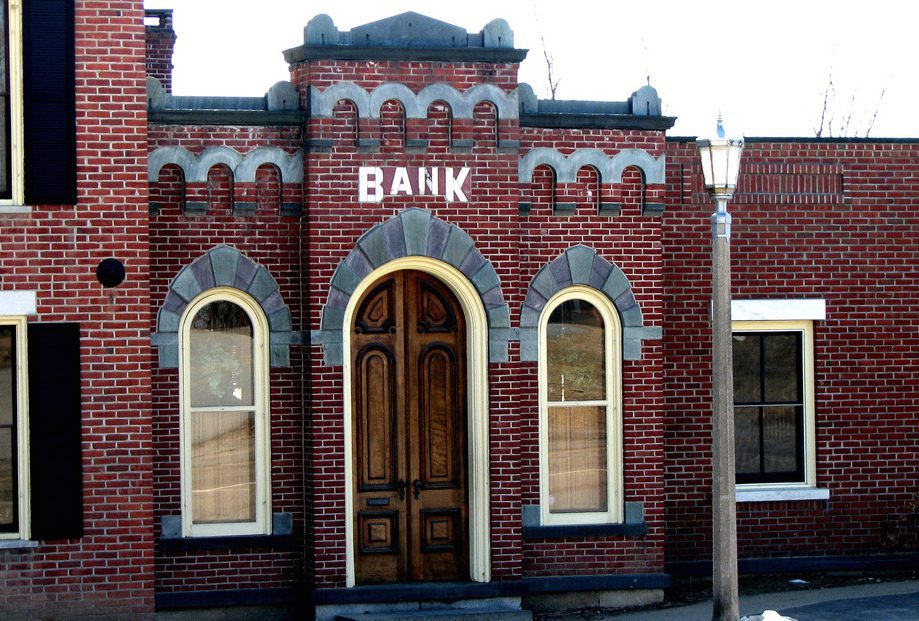

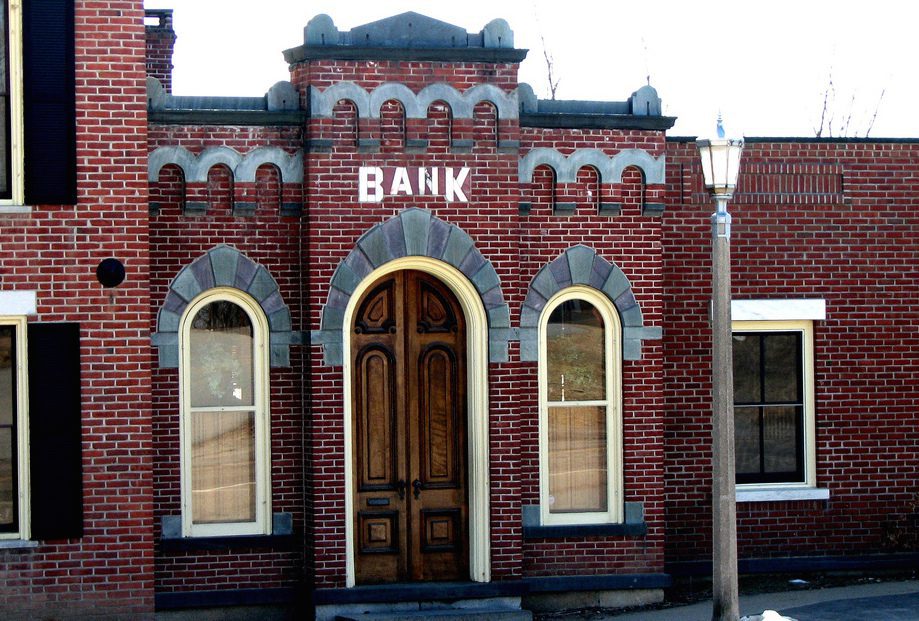

There was an article published in American Banker yesterday titled, Bank Branches Don’t Die, They Evolve. For those who don’t have access to the article let me summarize.

The author is basically saying that people of all ages like to deal with real people, particularly when it comes to finance. And while they may not visit a branch much, or at all, the fact that it is there is what really matters. People “want and deserve to personally interact with other people when it involves their finances.”

The author went on to say that the argument was made 30 years ago that branches would become obsolete but the fact is that branches are still alive and well today.

Not exactly. The number of bank branches has been in a steady decline for many years. According to this Washington Post article from April the World Bank predicts that the number of branches in the US by 2025 will drop 33% from their 2004 levels. In Europe that number will be 45%. Clearly the number bank branches is in decline.

The author ended the article with this quote that he initially wrote 30 years ago that he argues is still just as true today and will also be true in 20 years time:

The delivery system of the future exists today in the form of the brick-and-mortar system of thousands of financial institutions. The traditional branch will continue to evolve in terms of becoming more automated; more sales oriented with an increased array of products; more innovative in terms of type and locational placement; and even more fee generating with branch-sharing arrangements and new pricing strategies. And branch networks will continue to be reconfigured through closings, sales, purchases, switches, relocations, downsizings, and openings to reflect changing demand and supply conditions. This means that the delivery system of the future will be a product of evolution rather than revolution.

I couldn’t disagree more. The fact that someone would say that the world of banking today is the same or even similar to the world of banking in 1986 is astounding to me. While I believe that banks will be around for many decades and possibly many centuries the challenges facing banks today are so vastly different to the challenges faced in 1986.

The demographics that has driven the growth of marketplace lending is the same demographic causing the decline in the number of bank branches. Talk to a typical millennial today and ask them when was the last time they visited a bank branch. Most will say it has been many months or even years. They simply don’t want to do banking that way. And I would even question whether or not they think it is important to do their banking with a real person. Mobile and online banking serves the vast majority of their needs.

When it comes to investing, something that most millennials are just getting started with, I would argue that the popularity of robo-advisors like Betterment or Wealthfront are better suited to serve the needs of this new generation. SoFi has started making inroads here as well with a similar service that is slightly more high touch but still very much tech-oriented.

Any banking executive who thinks that the average millennial will come into their branch to discuss wealth management options is going to be sorely disappointed. But I foresee a time in the not too distant future when a bank could invite their customer into their virtual branch (through a virtual reality connection) and sit down to discuss investing options. When that kind of technology becomes mainstream the number of branches will plummet far faster than is happening today. But that is a topic for another day.

The bottom line is this. Banks play a very important role in our society and financial system. But I think the bank of tomorrow will be so vastly different to the bank of today that we can barely even conceive of it today. I certainly think in coming decades we will see massive declines in branch banking. The headwinds are simply far too strong to change this trend.