When I meet people at conferences one of things I hear most often is how much everyone likes the fact that I share my returns on Lend Academy. They like to see the real world returns of an investor that has been doing this for a while. Which is why every quarter I bring you my quarterly returns post. I have been sharing the details of my Lending Club and Prosper returns for many years and I am committed to keep doing it.

I now have ten different accounts, which I admit is a lot, but with taxable, Traditional IRA and Roth IRA in both my name and my wife’s name, spread across two platforms, I have found this number to be necessary. I will go through each one of these ten accounts below and provide you with a screenshot as well as a little explanation of each one. But first, let’s get right to the numbers.

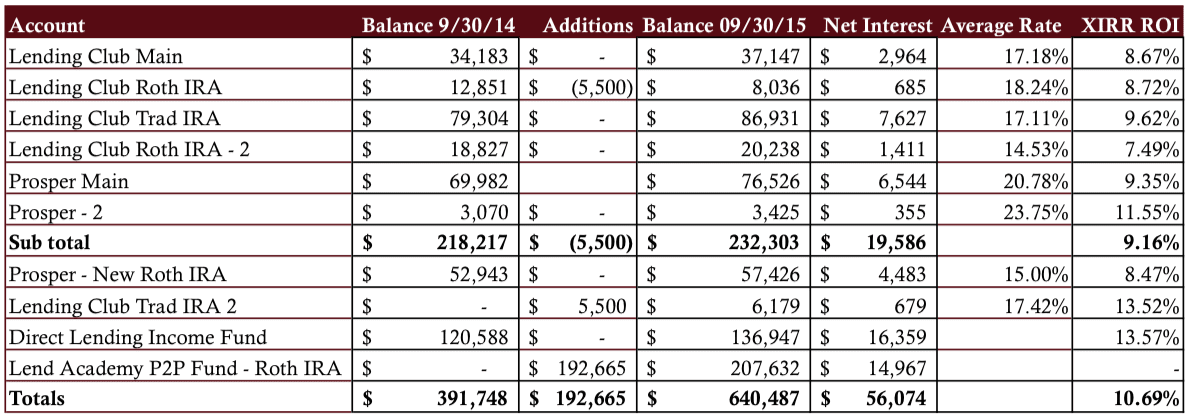

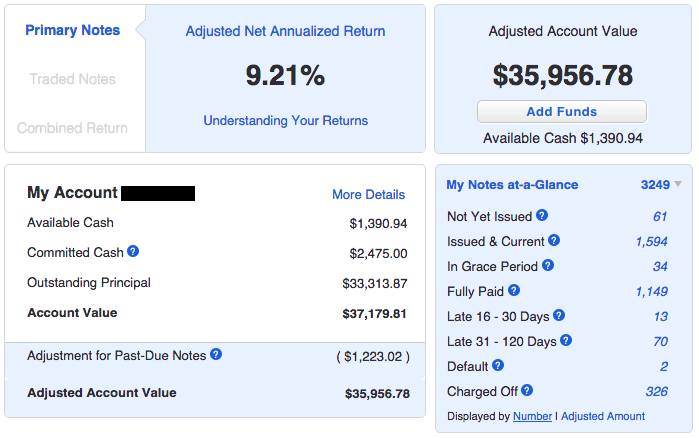

Overall P2P Lending Return Now at 10.69%

This past quarter saw a decline in my overall return from 11.30% to 10.69%. The main reason for the decline is the continued lower interest rates for my core six holdings (each one has been open for several years) at Lending Club and Prosper. The return there is down to 9.16% versus 9.51% in the second quarter. While I continue to suffer from a large number of defaults the situation is exacerbated by the decline in interest rates. My weighted average interest rate of each investment, for the most part, has been going down as higher interest loans mature and the money is reinvested into lower interest loans (with the same credit criteria).

Now on to my numbers. Click the table below to see it at full size.

As you look at the above table you should take note of the following points:

- All the account totals and interest numbers are taken from my monthly statements that I download each month.

- The Net Interest column is the total interest earned plus late fees and recoveries less charge-offs.

- The Average Rate column shows the weighted average interest rate taken directly from Lending Club or Prosper.

- The XIRR ROI column shows my real world return for the trailing 12 months (TTM). I believe the XIRR method is the best way to determine your actual return.

- The four newer accounts have been separated out to provide a level of continuity with my previous updates.

- I do not take into account the impact of taxes.

- The extended chart showing returns displayed at Prosper and Lending Club as well as my adjusted returns can be viewed here.

Now, let me go through each account in turn, to give you some context to the above table.

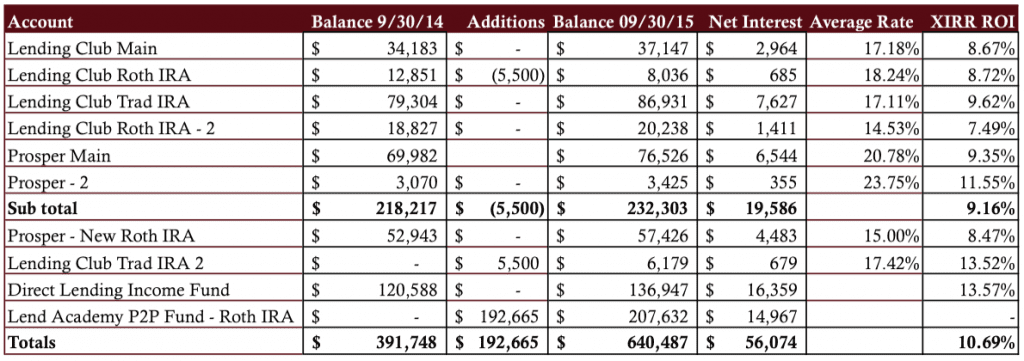

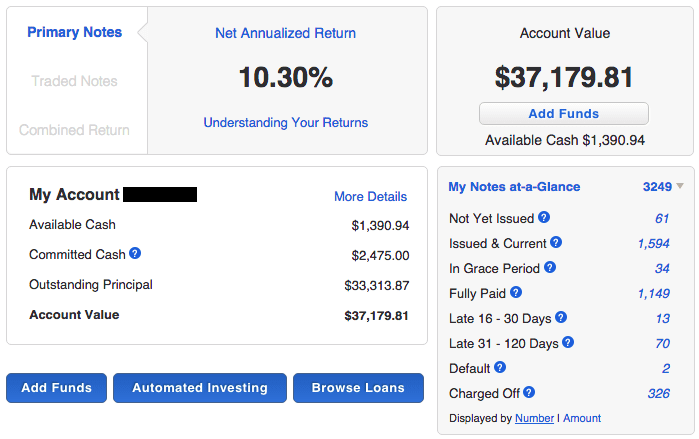

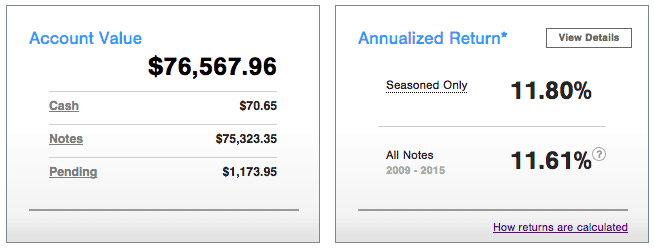

Lending Club Main

This was my first account that has now been open for over six years. It has gone through several different strategies over the years. I started off in a conservative way like many investors but gradually transitioned to a more aggressive approach. This is a taxable account and as I have said before, I will not be adding to any of my taxable accounts again – I believe a retirement account is the best way to invest in this asset class.

You will see two graphics with this account. I have taken a screenshot of both the standard account screen (above) as well as the screen that shows adjusted returns (below). You can see the difference in the return numbers for both – the adjusted returns looks at all your late loans and adjusts your return accordingly. It is a more accurate way to look at returns particularly for newer accounts. You can see my accounts have a more than 1% difference between the regular and adjusted NAR.

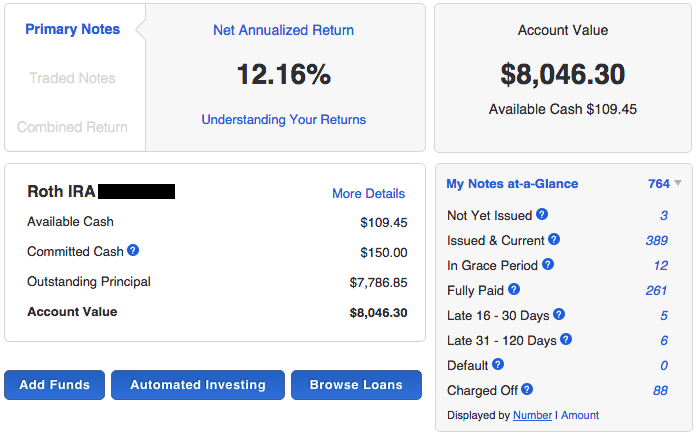

Lending Club Roth IRA

This is my most aggressive Lending Club account with the highest average interest rate and it has been that way since I opened the account in early 2011. I have only invested in loan grades D-G from day one but that comes with higher potential returns but higher defaults as well. While this account has historically been my best performing Lending Club account I have had a rash of defaults in the last few months that has brought the return down.

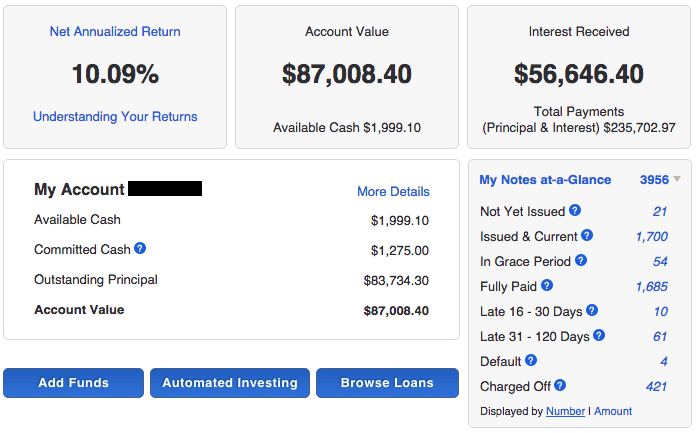

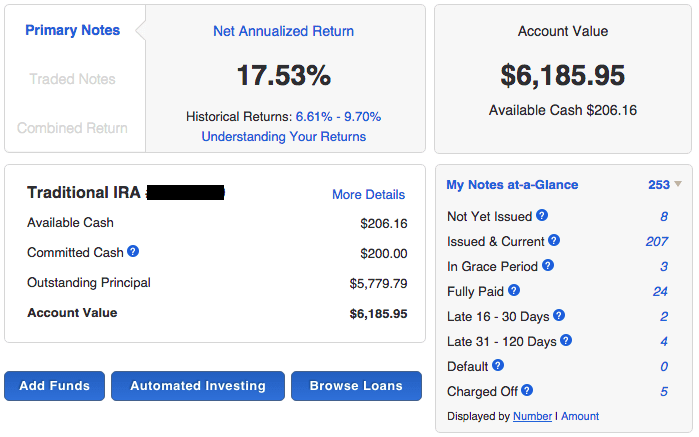

Lending Club Traditional IRA

This is my wife’s Traditional IRA and it is also my largest account at either Lending Club or Prosper. I opened this account in April 2010 by rolling over several 401(k)’s and IRA accounts that my wife had accumulated over the years. After dipping down to around 8% last year this account is now my best performing Lending Club account among my original four accounts there.

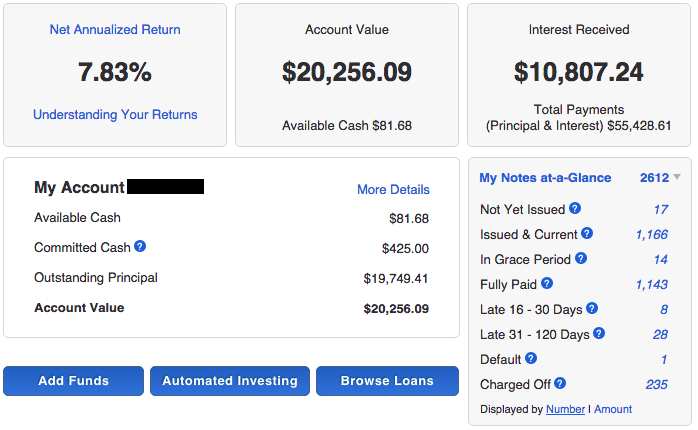

Lending Club Roth IRA – 2

This account used to be my most conservative in my portfolio. It was originally setup as a Lending Club PRIME account in 2010 and I let Lending Club manage my investments for me investing only in B- and C- grade accounts. I still let Lending Club invest automatically in this account but I now do so using my Super Simple filter which is more aggressive. My returns have increased from a low of below 5% to around 7.5% today.

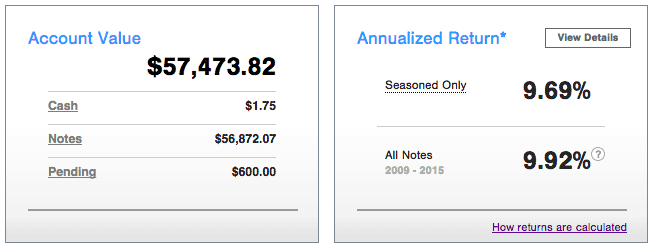

Prosper Main

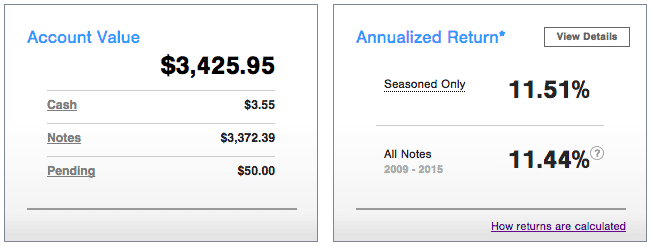

Switching over to Prosper, we see my original Prosper taxable account. I opened this account in 2010 and eventually invested $50,000 after slowly adding to it over a several year period. This has been my most consistently high performing account but my very long run of (real) returns in the double digits came to and end this quarter. My XIRR return of 9.35% was the first time I have been under 10% since I opened the account.

Prosper – 2

This is my most volatile and least diversified account. It has always been something of an experiment for me as I like to see what happens when you only have 100 notes or so invested. And I have only invested in the most aggressive notes as you can see by my 23.75% weighted average interest rate. What happens in an account like this is that defaults have an outsized impact. Just one year ago real returns on this account were under 5%, today they are back over 11%.

Prosper – Roth IRA

I opened this account a little over 18 months ago with a slightly different intention. All of my other P2P lending accounts are investing aggressively in higher risk loans, so I wanted this account to take a more conservative approach. I rolled over $50,000 from a Roth IRA account and I have my own firm, NSR Invest (formerly Lend Academy Investments), manage this account with our balanced portfolio. It invests primarily in A, B and C grade loans at Prosper using our own models.

Lending Club Traditional IRA – 2

This account was opened out of necessity. I needed to do a re-characterization of my Roth IRA because of income limitations. I had to move $5,500 from my Roth IRA to a Traditional IRA, a process that Lending Club made very easy. This is a new account and like all new accounts the Net Annualized Return number that Lending Club provides is pretty meaningless. I like that Lending Club includes the Historical Returns range on new accounts now – that gives a much more accurate picture. I expect my long term returns here will fit somewhere within that range.

Direct Lending Income Fund

But for the Direct Lending Income fund my overall portfolio would be earning under 10%. This continues to be my best performing investment with a 13.52% return. I think Brendan Ross, the fund manager, continues to do an excellent job on delivering on his promise to investors and this is one of the success stories of this industry. The focus of this fund is in short term high yield small business loans through a variety of online platforms.

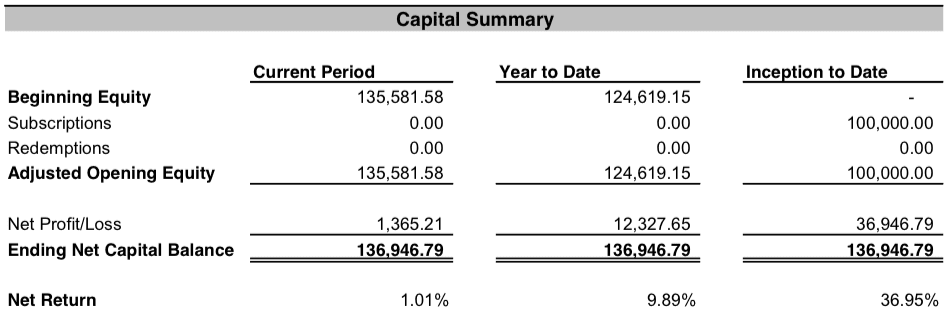

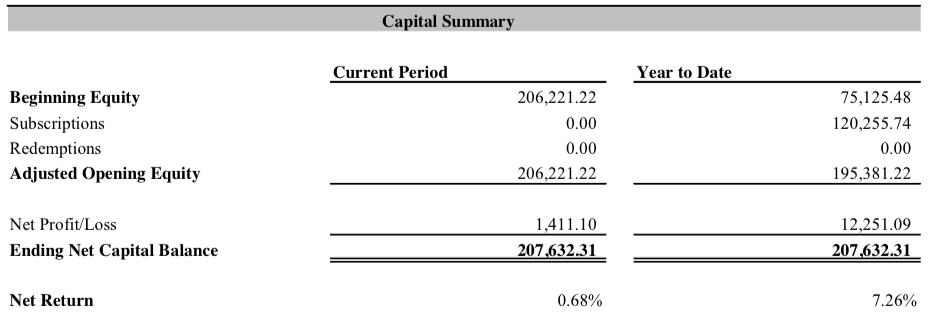

Lend Academy P2P Fund – Roth IRA

You may remember that earlier this year my investment management firm Lend Academy Investments merged with NickelSteamroller to create NSR Invest. We offer a private fund for accredited investors and late last year I rolled over part of my Roth IRA into this fund. In March, I rolled over another part of this Roth IRA so I now have around $200,000 invested in our fund. It invests in the loans issued by Lending Club, Prosper and Funding Circle with a small position in Upstart as well.

Final Thoughts

A couple of years ago it was relatively easy to earn a double digit return on Lending Club and Prosper investments. That situation has changed today and while it is still certainly possible, most large established accounts will earn less than 10% in the long run, which is still an excellent return in the whole scheme of things.

At the end of every quarterly update I like to highlight one number: Net Interest earned. This is the number that shows the actual gains in your account (before taxes). I always like to see this number grow because this is the actual money you can use. Every quarter since I started doing these reports this number has grown and it now stands at $56,074 interest earned over the past 12 months

Let me know what you think. I am always happy to discuss these numbers with you.