Many Lend Academy readers use the Foliofn trading platform (also called the secondary market) a lot. For some investors it is the only way that they can invest in Lending Club notes. After promising improvements for a long time Lending Club is finally rolling out some significant changes to the secondary market.

Some have already noticed one change that was rolled out a couple of weeks ago and this afternoon there were several more changes. This post will break them all down for you.

More Filters

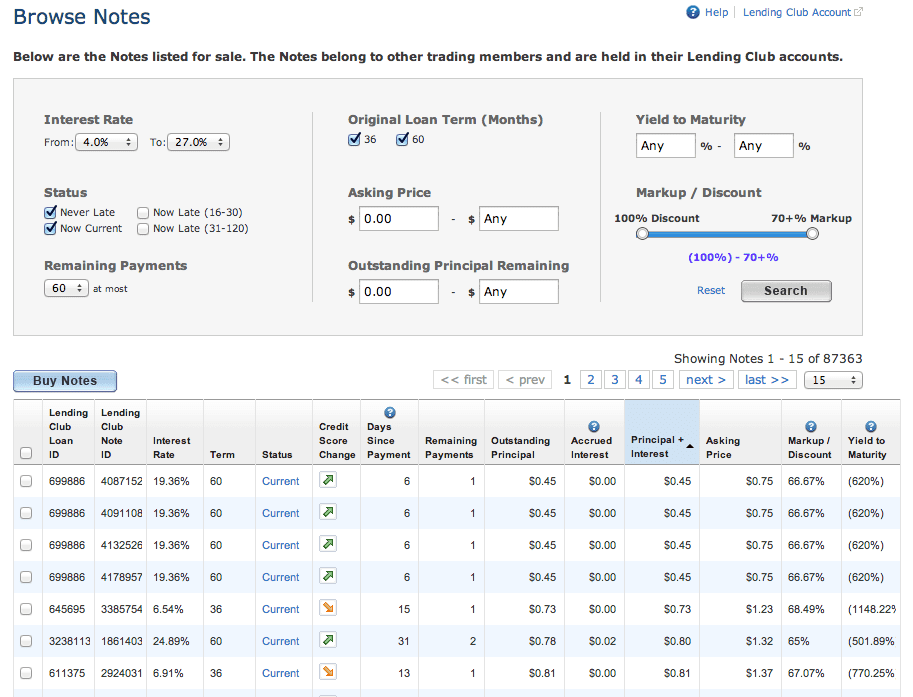

One of the big complaints that I (and many others) have had is that there are not enough filtering options on the trading platform. Right now you have basically three options: interest rate, loan status and number of remaining payments. That has changed with this update today as you can see in the screen shot above.

The Browse Notes section now includes five new filters:

- Original Loan Term

- Asking Price range

- Outstanding Principal range

- Yield To Maturity (YTM) range

- Markup/Discount range

This is a decent start. Eventually, I would like to see the exact same filters on the Folio platform as there is on the retail platform. You should really be able to use the same saved searches on both platforms but that change is probably still a long way off.

Download All Notes

This has the potential to be really useful for doing filtering offline. Or for those people who want to create a programmatic solution to their Folio investing. I know some people who do screen scraping to pull in every Folio note but at more than 67,000 notes as of this morning that is a lot of data to pull in.

Now, you can just click the Download All link and you will have access to all the loans for sale.

Cannot Sell Notes When A Payment is Processing

There is a little loophole/trick that some investors have exploited to offload their notes that are about to go late. I am not going to detail it here but there was a loophole that allowed investors to sell a note the day before it went into In Grace Period if they knew how to exploit it.

That loophole has now been closed. Investors will no longer be able to list a note for sale once Lending Club has begun processing the payment. Now, it takes several days for Lending Club to process a payment so from now on there will be a few days every month where notes will not be able to be listed for sale.

For most investors this will be an inconvenience and for some it will be a major blow because the loophole will now be closed. I support this move, though, because it will help cleanse the secondary market of notes that are about to go late.

There are a couple of other minor changes to the monthly statements. You can read Lending Club’s description of all the changes here.

I have been told there are many more changes coming this month, some that will affect all investors. I will detail them here as they happen.

So what do you think Folio users? Do you like these changes? As always I am interested to hear your comments.