I have been following the batch of loans that were issued between July 2009 and June 2010 for quite some time now. You can read my first analysis of these notes here and the second analysis here. This latter analysis was done over a year ago.

Many of the notes issued during this time period have now reached maturity and those that haven’t will do so within the next nine months. Regardless, we can assume that the vast majority of principal has been paid back on these loans so we can get a very good idea now of their overall performance.

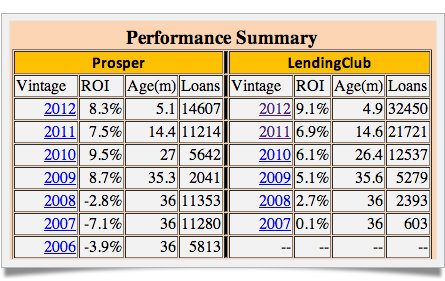

Below is the table showing the results from both Lending Club and Prosper.

[table id=37 /]

Here are a few points to make about this table:

- This is a comparison of 3-year loans only, the first two analyses inadvertently included a few five year loans at Lending Club.

- For the Lending Club data I used Lendstats and for the Prosper data (other than ROI) I used Prosper’s Performance page.

- The Default Rate is not an annual rate, it is the total percentage of notes that have defaulted.

- The Default Loss percentage is the total amount of principal that has been lost. This number is lower than the Default Rate because with most defaults some payments are made before the loan defaults.

- The ROI column is not exactly an apples to apples comparison – I use Lendstats for the Lending Club ROI number and Prosper Stats for the Prosper number. Lendstats no longer provides analysis of Prosper data.

- Prosper has a higher default rate but also a much higher average interest rate that more than compensates investors for these defaults.

Even though the ROI numbers were not calculated using the same formula it is pretty clear that Prosper has outperformed Lending Club over this time period. This is confirmed by the Lendstats numbers from their home page that show Prosper with a clear advantage over Lending Club for notes issued in 2009 and 2010.

More P2P Loans Have Reached Maturity

One of the great things about investing in p2p today is that there is a bigger database of completed loans than ever before. We finally have some Prosper 2.0 loans that have matured and it is pretty clear that they came out after their quiet period and provided excellent returns. Those investors who were brave enough to invest in Prosper 2.0 right after they opened back up have been rewarded very well for the risk they took.

Now, the past is no guarantee of future results and this article is not meant to say that Prosper is a better investment than Lending Club today. In fact, the Lendstats numbers seem to indicate that Lending Club is doing a little better than Prosper for notes issued in 2012.

What is great for investors, though, is that we will be able to see for ourselves. By the end of this year all 2009 loans will be in the books. There will be no more guessing on loss rates, the data will speak for itself.

I will do another update on this batch of loans next summer when all the notes will have matured. But I will be surprised if we see numbers that are much different from today.

I am interested in hearing from others. What do you think of this data?