Another great month at Lending Club combined with a significantly down month at Prosper meant that we still haven’t quite broken $100 million in loans in one month yet. I thought it was a safe prediction that milestone would be broken in November. But Prosper was down over 20% from last month which certainly caught me by surprise. Let’s dig a bit deeper into the numbers at both companies.

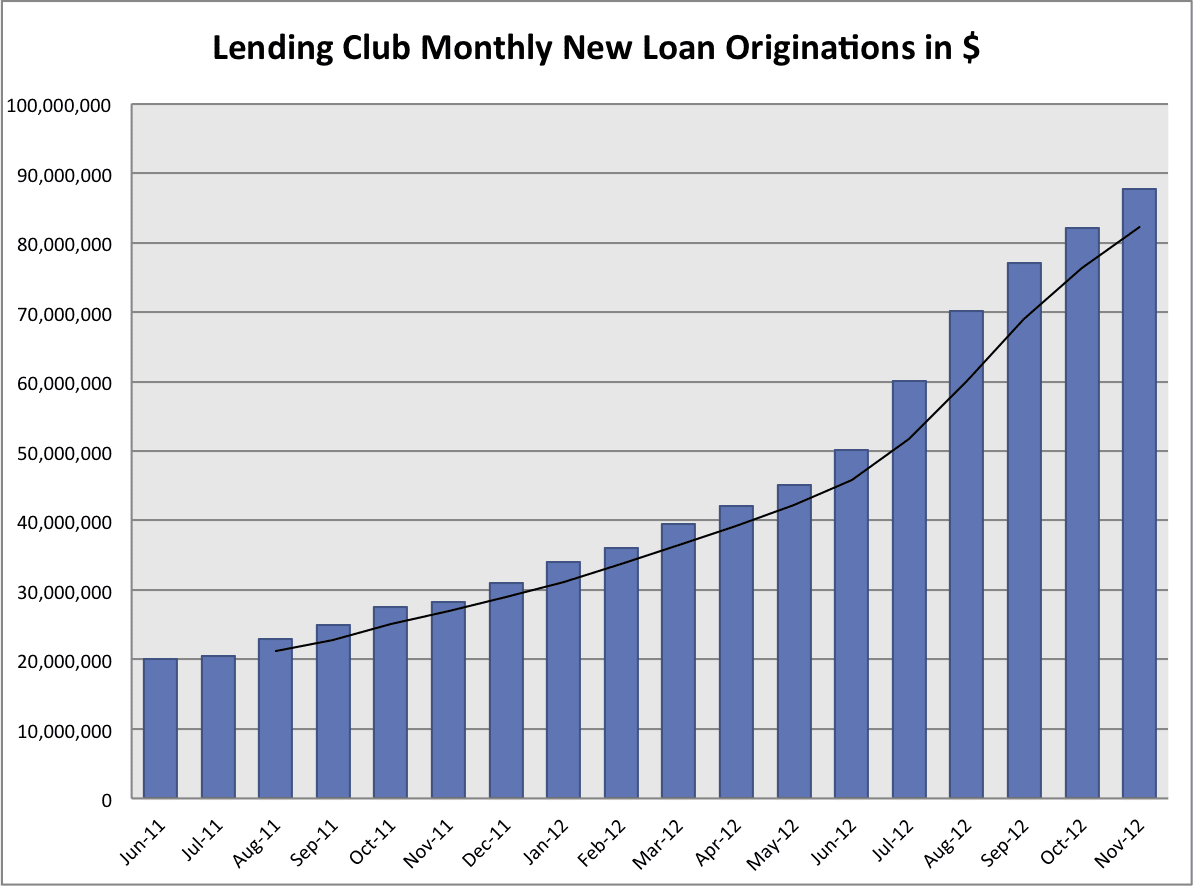

Lending Club Issues $87.7 Million in Loans in November

The big news from Lending Club this month was crossing $1 billion in total loans issued, a milestone that happened on November 5th. But Lending Club certainly didn’t rest on their laurels. Despite a holiday shortened month in November they were up $5.7 million over the previous month.

There was a sharp uptick in average loan size this month at Lending Club. The average loan size was $13,741 which is the second highest on record, so plenty of large loans must have been issued this month. After hitting a 12-month low in September of $12,654 the average has increased significantly the last two months.

All in all it was a pretty typical month at Lending Club – up around 7% over the previous month. Below is their 18-month chart; the ever increasing black line is the three month moving average.

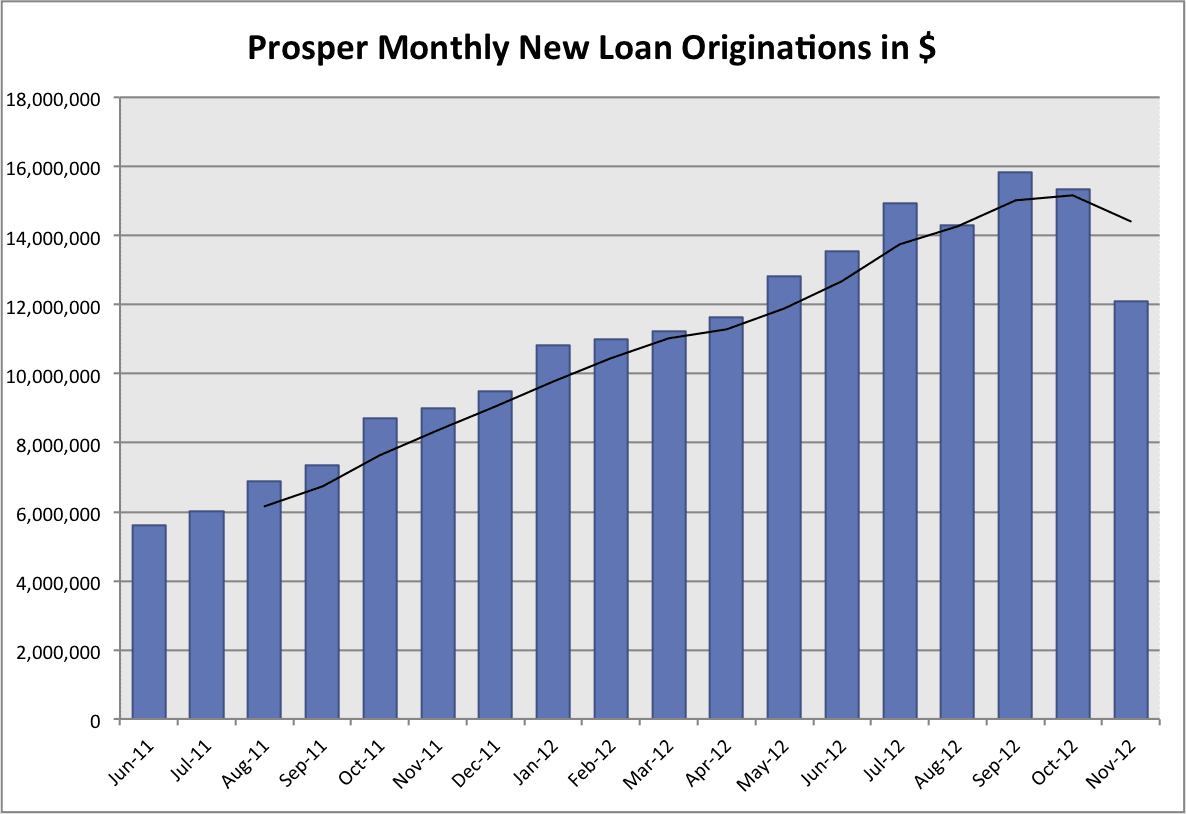

Prosper Issues $12.1 Million in Loans in November

Anyway you look at it this was a disappointing month at Prosper. After a record month in September of $15.8 million the trend has been downhill since then clearly demonstrated in the chart below. What is even more surprising is that the number of loans on their platform was the most ever – often more than 800 and sometimes as much as 1,000 loans available. For the first time since I started closely following this industry two years ago Prosper had consistently more loans available to investors than Lending Club this month.

Despite this increased choice in borrowers investing slowed down. Digging into the investor numbers, courtesy of Prosper Stats, it is pretty clear what happened. Worth-blanket2, by far the largest investor on Prosper, had a very small month by their standards. They invested just $661,000 which is well down from their 12-month average of $3.2 million. The number two investor, Index_Plus, had a pretty typical month and almost eclipsed Worth-blanket2 as the top investor with $612,000. The number three investor, MI2, was down 85% from last month and they invested a paltry $155,000 compared to the $1 million to $1.3 million of the previous three months.

So, two of the top three investors curtailed their investments sharply this month. If they had both had a typical month of investing that would have added around $3.6 million to the total and Prosper would have been close to a record month. The question is why did they stop investing?

I reached out to Prosper for an official response but received only a meaningless marketing-spin response back that wasn’t worth including. So, here is my theory. Back in April I discussed Prosper’s new bankruptcy remote vehicle, Prosper Funding LLC, that will protect Prosper investors in the event of a bankruptcy. Well, there was a lot of activity with the Prosper Funding SEC registration this month. This could well indicate that approval of this entity is imminent. Prosper would not commet on this whatsoever because they are in a quiet period with this registration. It makes sense, though. If this registration is imminent, and the big investors would likely know this, that they may be sitting on the sidelines until the registration is in place.

With the huge increase in borrower volume this month it seems to me that maybe Prosper is gearing up for an onslaught of investor money. Now, I acknowledge this is an optimistic view and I could well be wrong but I am not writing off Prosper just yet.

Below is their 18-month chart which until recently was looking quite healthy.