Retail investors who are looking for a more hands-on approach to investing in p2p lending have used third party automation tools for portfolio management, analytics and order execution. BlueVestment is among the favorites and today is releasing both a new user interface to their users and their new proprietary scoring model, BluePicks. They also recently merged with Interest Radar, another third party tool that has been in this space since the early days. I spoke to Jon Pildis, Director of Business Development at BlueVestment and Nathan Marcos, Founder of BlueVestment to learn more about these recent developments.

Merger With InterestRadar

Last month, BlueVestment and Interest Radar announced that they were merging. They will operate under the combined entity, BlueVestment, LLC and will continue their focus on Lending Club. Jon acknowledged that Interest Radar had many features that are currently not available in BlueVestment and that to maintain their commitment to their current subscribers, Interest Radar will continue to operate as they take an estimated 3 months to build out the functionality within BlueVestment. Combining the user base and new functionality, along with the development experience of Ricardo Basto (Interest Radar’s founder) will solidify BlueVestment’s place among the top third party tools available.

Introduction of BluePicks

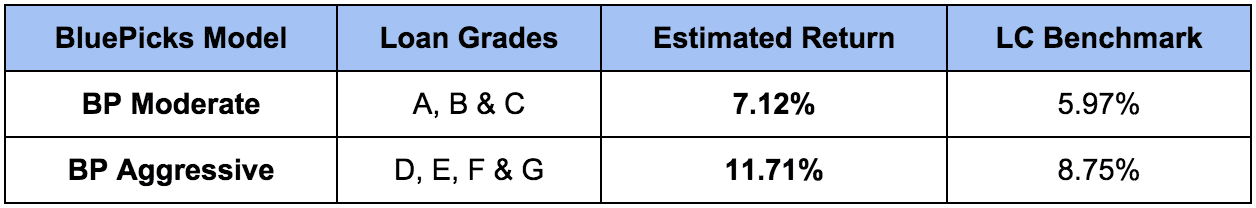

With the recent closure of P2P-Picks, BlueVestment, who have been integrated with P2P-Picks for quite some time, sought to develop a similar model of their own. Today, they are releasing BluePicks to their subscribers. The models have been in use through Interest Radar for years, but this latest iteration will include their most up-to-date risk model. According to their documentation, each of the two models were built to include the top 20% of historical loan volumes. Users will be able to use filter criteria on top of the models with filters for grade, BluePicks percentiles and others. The two models are BluePicks Moderate (BPM) and BluePicks Aggressive (BPA).

- BluePicks Moderate: This model is similar to P2P-Picks Loss Minimizer, with the addition of C grade loans. Projected returns for the grades are as follows: A (5.07%), B (6.72%) and C (8.69%). The overall projected return across BluePicks Moderate is 7.12%.

- BluePicks Aggressive: This model is similar to P2P-Picks Profit Maximizer. The C grade loans were removed as the team at BlueVestment believe that these loans may bring down returns on a model that is supposed to maximize returns. Projected returns for the grades are as follows: D (11.06%), E (11.74%), F (13.30%) and G (18.21%). The overall projected return across BluePicks Aggressive is 11.71%

It is important to keep in mind that underwriting is always evolving at Lending Club. This means that the projected returns are based on historical data and as such, do not guarantee future results.

New User Interface

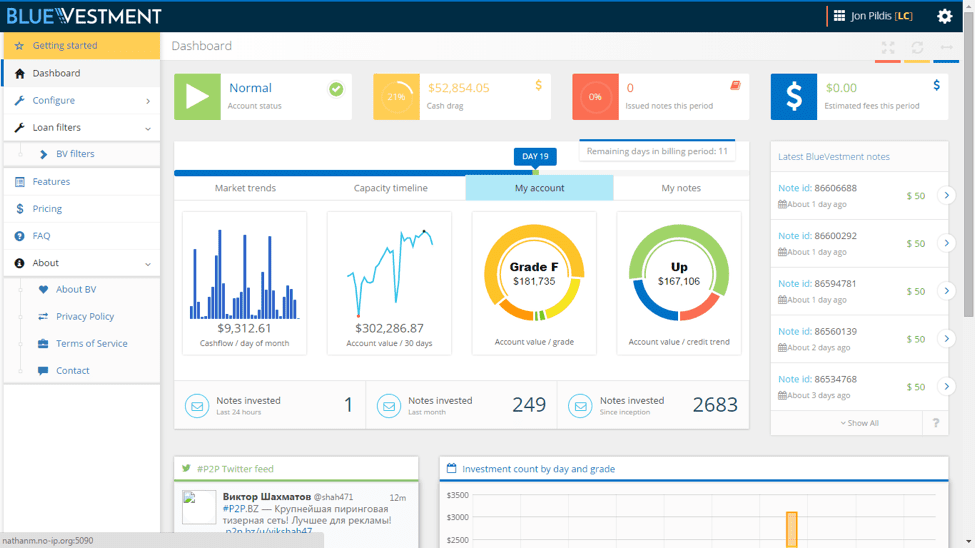

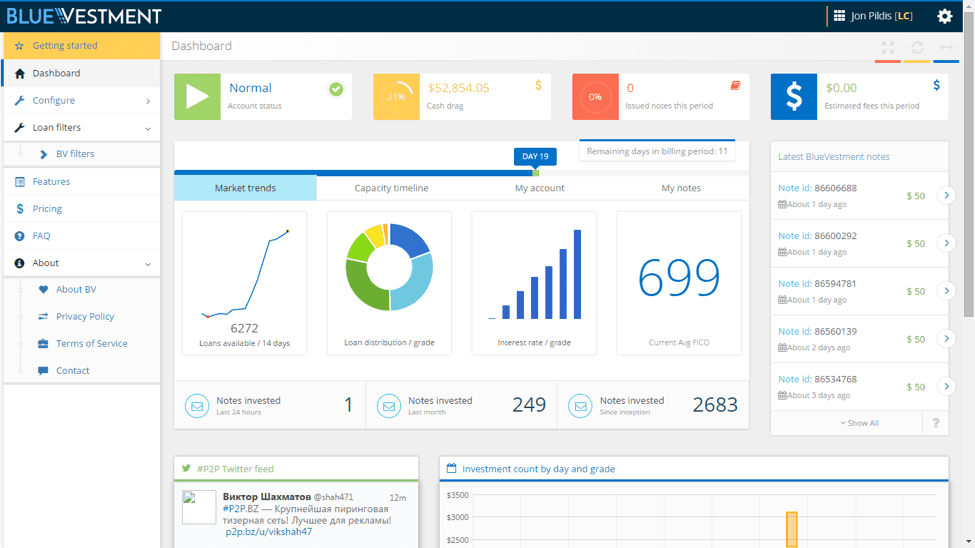

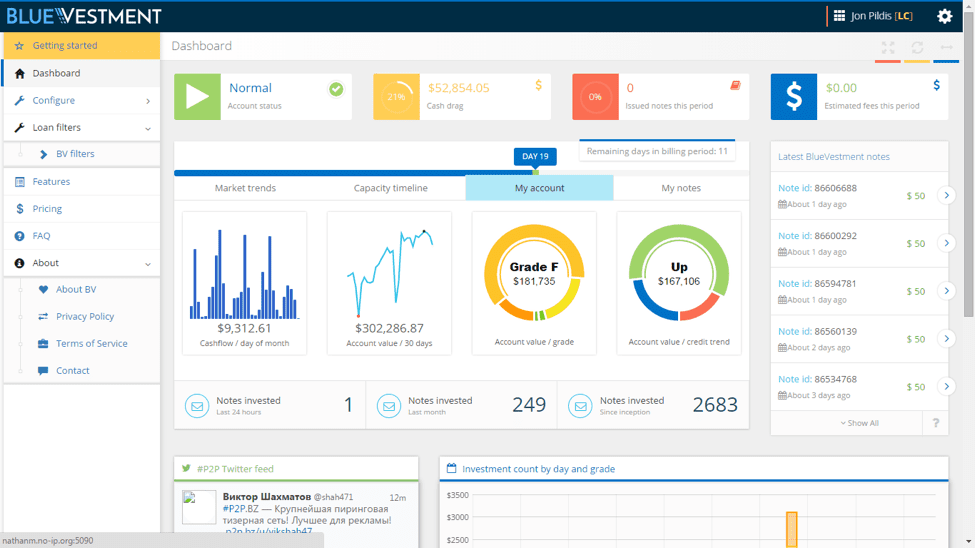

The new user interface is both mobile friendly and uses the latest technology with HTML5. Nathan pointed out that data is automatically refreshed, meaning there is no need to refresh the page within your account. The most significant change to the BlueVestment interface is the addition of a dashboard that offers several data points. The first tab gives users a look into the current trends at Lending Club. This includes loans available, loan distribution, interest rate/grade and average FICO.

The second tab gives metrics specific to a user’s account showing cashflow, account value, account value by grade and credit trends.

The other functionality within BlueVestment remains the same, albeit with a new look. Users can assign basic filters or advanced filters with nested conditional statements to auto-invest. I asked Nathan and Jon what users can expect in the future and they teased several ideas, including more credit models, FOLIOfn functionality and finally the addition of other originators. If you’re interested in joining BlueVestment, they offer free investing if you invest less than $1,000 during a given billing period. After that, they have a tiered pricing structure that varies from 0.20% to 0.45% of amount invested over $1,000.

It is nice to continue to see the focus on the retail community of investors who were key to the success of this industry in the early days. We recently covered all of the major tools available, but there have been significant changes in the last few months with many of these companies. It seems as though we are reaching the point that the companies who are still around today will have the staying power for the long term.