Today we have a guest post from Sarah V., who lives in Cambridge, Massachusetts. She is only able to invest in Lending Club through the Folio platform something she has been doing for about eight months. She manages her own investments, does her own taxes with paper and pencil, and has had an interest in investing since she was a kid. She is a regular contributor on the Lend Academy forum.

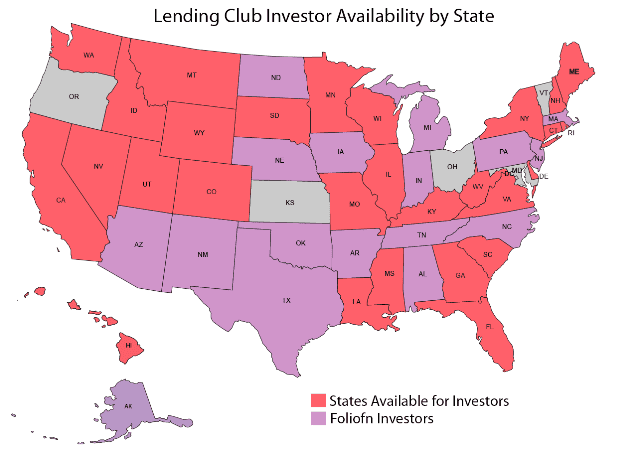

Much has been written about Lending Club – statistical analysis, strategies, and the like. But some of us are living out in the wilderness, in “trading only” states where you can invest via FOLIOfn but not the Lending Club retail platform. If you’re in one of those states, this blog post is for you! [Editor’s note: the purple states in the map below are the Folio-only states.]

I’ll put it bluntly: the FOLIOfn interface is terrible. It’s slow, and it’s missing an enormous amount of features it really should have. But it’s not impossible to use and sometimes, if you’re savvy enough, you can even use its clunkiness to your advantage.

Buying notes on Folio

There are a few schools of thought on how to use the FOLIOfn platform to buy notes:

- Sort by markup/discount, thus finding the best deals.

- Sort by yield to maturity to get the best bang for your buck. (Note: this option has recently been removed, but will hopefully come back soon.)

- Simulate the retail platform experience by purchasing newly-issued notes, which you can find by clicking both the “Now Current” and “Never Late” notes and sorting by Loan ID number or Note ID number (highest first).

- If you have a higher appetite for risk and you’re a very hands-on investor, you can make a lot of money by buying and selling distressed notes, heavily discounted notes, and late or grace-period notes.

The problem comes in when you realize that almost every note on FOLIOfn is there because someone decided they didn’t like it. Usually there is a reason they didn’t want it, and often that reason means you don’t want it either. This results in a lot of lousy notes that you have to look through to find the good ones. Here are a few things to look out for on the “Loan Performance” page:

- Notes that are in the midst of processing a payment: “Processing” notes that are heavily discounted are usually about to be late. Don’t buy those without knowing what you’re getting into. There’s also a chance that the payment will arrive right after you purchase the processing note, and the sale will be canceled.

- Notes where the FICO has dropped precipitously: FOLIOfn uses an up/down/straight arrow system, but does not tell you if the FICO has dropped 5 points or 200 points unless you open the loan performance page and open the FICO chart. A large drop may be a sign that something is going to go wrong. Sometimes these notes turn out fine, but you should probably be paying a discounted price for these, if you are willing to buy them. On the other hand, you can sometimes get a deal on something with a very small FICO drop, because many investors skip over anything with a down arrow.

- Notes that have worrying comments beneath the payment history: Comments beneath the payment history are usually a bad sign – either a payment has failed, or someone is declaring bankruptcy, or they are going on a payment plan. Again, don’t buy those unless you are getting a discount appropriate to the severity of the comment.

Selling notes on Folio

Now, let’s talk about the other side of things: selling notes. The trick to successful note-selling is to think like a buyer. Ask yourself: how would a buyer find this note? Try to look for it yourself and see if you can find it by any common methods (sort by high yield, low markup, etc.). If someone has to go through forty pages of notes to find yours, it’s probably not going to sell. Usually the only thing you can do to make it sell faster is to lower the price. That will make it go closer to the top of both the high-yield and low-markup sorting methods.

I find that higher-interest-rate notes sell a lot faster than low-interest-rate notes. If you are investing in conservative A and B grade notes, your investments will be extremely illiquid unless you are willing to lose money when you sell them. If you are selling D-E-F grade notes you could probably get most of your money out in a couple of weeks without losing anything.

An new alternative for Folio investors

Recently I have started using InterestRadar.com, which has a FOLIOfn search option on the Analysis page. I can’t recommend this enough for FOLIOfn investors – it’s a huge time-saver! It will allow you to try out complex, granular investing filters just like the retail platform. It also allows you to pick out real gems that would otherwise be near-impossible to find via the sorting on the FOLIOfn interface. One strategy I like that is much easier on Interest Radar is filtering for notes that have a proven payment history of two or three months, which weeds out all of the scammers who signed up for a loan and then immediately declared bankruptcy or ran off with the cash.

If you decide to use the filters on Interest Radar, try making several of them that don’t overlap – otherwise you will have to look through the same notes more than once. I have an “ideal notes” filter for the best of the best, which rarely turns up anything (but if it does, I want it badly!) and a “second best” filter for notes which meet my standards but aren’t quite as good as the other filter. This way if I have a limited amount of money to spend, I know I will see the best notes first.

One last tip: your returns in a buy-and-hold strategy will probably be a little lower than the same strategy on the retail platform. You will often pay a small premium on the best notes, or you will buy them a couple of months old, after the highest interest payments were already paid. If you buy the highest-grade A notes, you may well end up with a mere 1-2% annual return, which could be easily wiped out with a few defaults and taxes (if you’re not investing within an IRA). You don’t have to go for the riskiest notes, but you should probably avoid single-digit interest rates if you are investing solely on FOLIOfn.

Have you got any other tips or cautions for FOLIOfn investors? Let’s hear about them in the comments!